SHARE

“It’s been 20 years ,” I tell the group of investors with whom we meet once every few months. However, my words went unheard and drowned in the noise. “20 years since I started ” I repeat a bit louder. Only Chris heard me and understood. He raised his beer from across the table and winked at me. The attention of the other thirty people and all the noisy conversation revolved around the 42% return for the year that one of us was bragging about.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

The Problem

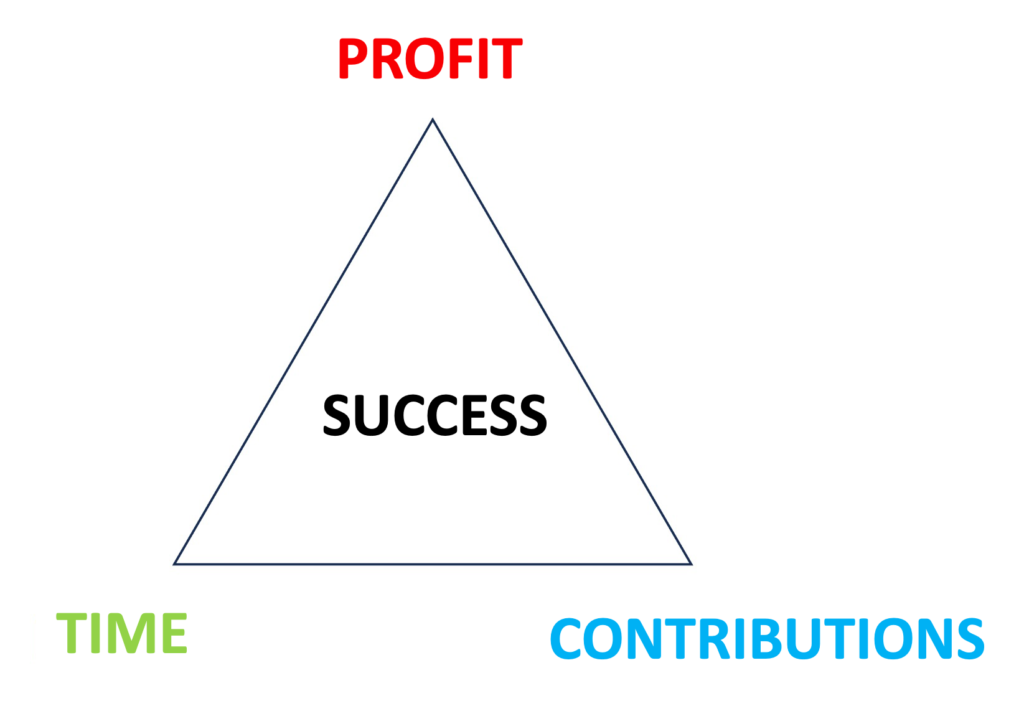

The three components on which an investor’s success depends are TIME, PROFIT and CONTRIBUTIONS.

- Time is the investment period.

- Profit is the percentage win(or lose) you make, say on an annual basis.

- Contributions are amounts that you set aside from your income and put into investments regularly (or as a lump sum).

The formula for investor success (or achieved financial goal) is extremely simple, namely – the more of each component, the greater the final outcome. I believe that any investor, novice or advanced, is probably intuitively aware of this.

Еquality

To create some visual idea of this process, imagine the investor as a juggler with three different colored balls. The three balls are the three components of our formula for success – TIME , PROFIT and CONTRIBUTIONS. Like any self-respecting juggler, he must avoid focusing on just one ball to not embarrass himself before the audience. Instead, his eyes must take in the entire configuration at once. This balance is crucial. If any ball slips from his hands, the whole trick fails. Then, the juggler goes home disappointed. But the balls do not slip from his hand, because the juggler does not have a favorite ball.

But why do we investors have a favorite ball?

Stability

Let’s use a second analogy. Think of the three components of the formula for success as the three legs of a tripod. A photographer uses this tripod to stabilize the camera that will capture your wedding photo. As you might know from math, a tripod is a very stable structure. It provides excellent balance for the camera. It won’t wobble, it won’t tip over at the most important moment. A tripod gives the photographer peace of mind. Should the tripod be made with one leg longer than the others? No! Otherwise, placed on a flat surface, the structure will be crooked and the balance of the camera will be lost.

But why do we investors keep insisting that one leg of our investor success formula be longer?

The Attraction of Profit

Imagine the following posts by three people in an investor’s Facebook group

“I’ve been investing for 25 years.”

“I invest $2,000 every month.”

“I made a 42% return this year.”

Can you guess which of the three posts will attract the most attention, elicit the most admiration and provoke the most comments? That’s right, you’re absolutely right. The last one. And there are reasons for this, which will be discussed a little later.

As you’ve probably already guessed, today we’re going to address the problem of over-focusing of many investors on the PROFIT component.

The Math

We will now put the analogies and allegories to rest and let the mathematics speak for itself. I will interfere only to help the conclusions and awaken those who fell asleep.

Our goal is to conclusively show that an investor who adopts a balanced approach—without chasing high PROFITs — will not only achieve satisfactory results but also exceptional ones.

We will play out in three examples the investment plans of two investors, where they will set different values for the components of a formula for success – TIME, PROFIT and CONTRIBUTIONS. We will compare these two plans and analyze how they drive their success. For convenience, in these examples the investor whose plan we’ll be looking at on the left will always aim for a conservative 10% return per year.

Practical Examples: Simulating Investment Scenarios

Example 1

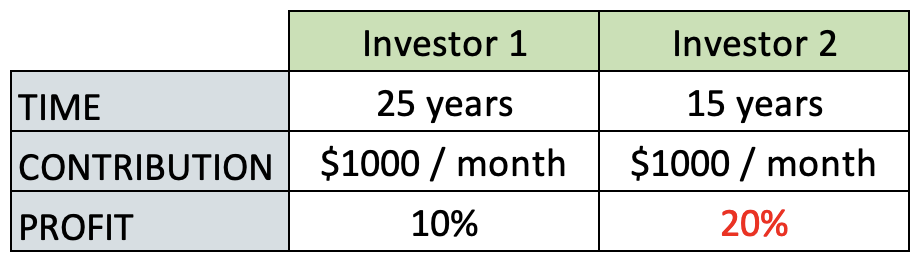

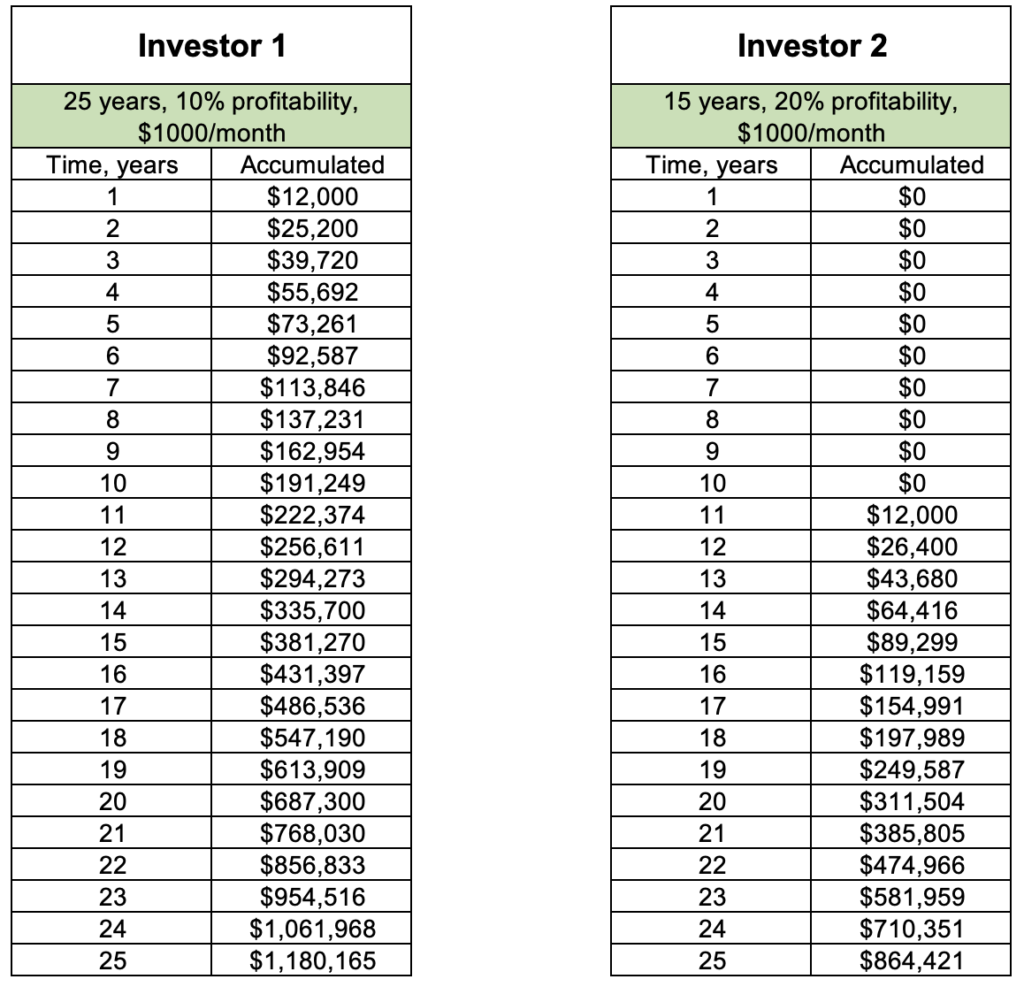

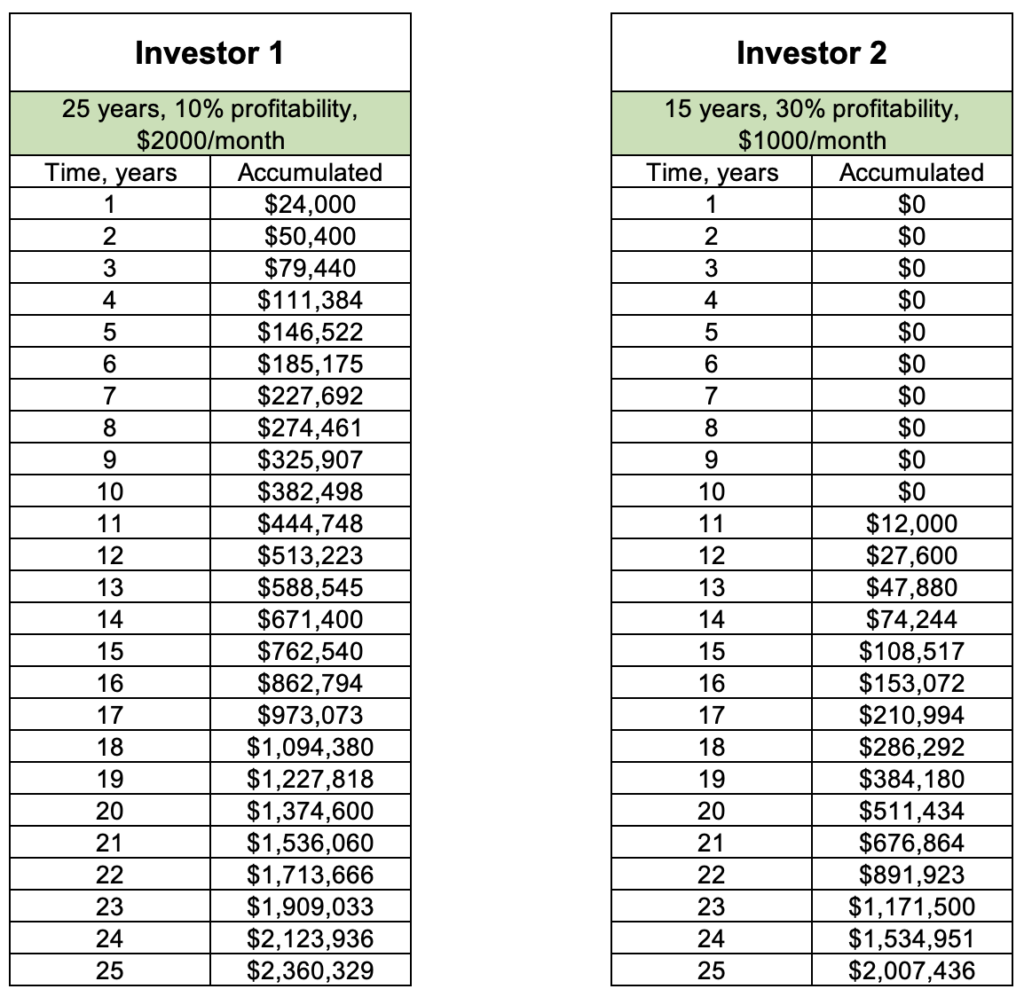

In this first example, we will compare two investment plans, where both investors decide to make CONTRIBUTIONS of $1,000 per month. The difference will be both in the duration of their investment and in the hypothetical PROFIT that they manage to achieve per year. I say hypothetical, and this is important to note here. While TIME and CONTRIBUTIONS are completely under our control, PROFIT is wishful thinking. For this reason, the models we will work with can only be a good theoretical wish in their PROFITABILITY part.

We have talked many times about achieving a 10% ROI per year on stock investments. It is achieved relatively easily by betting on a broad fund that tracks the US economy. One of the places you can read more about this topic is the article “Nik, Tell Me How To Invest”

So let’s begin.

In the table below on the left (calculated easier with a compound interest calculator), we see the dream of almost every person and absolutely every investor – to become a millionaire within their lifetime…fulfilled. The effort required in this example is to maintain the discipline of regularly setting aside funds for the CONTRIBUTION. The rest of the magic seems to happen by itself, without further intervention on our part.

In the right table, we see an investor who started his investment journey 10 years late compared to the left table. Perhaps he didn’t have a mentor, wasn’t interested in investing, or didn’t have other investors around to inspire him. For one reason or another, he missed the opportunity to begin this process from an early age. His first CONTRIBUTION of $1,000 doesn’t happen until 10 years later than the first investor. To achieve results like his early riser counterpart and eventually catch up, he should aim for a 20% ROI per year. We also set such a percentage in the calculation in this mathematical model. We can see that even with this increased rate, it still lags behind the end of the period we decided to track.

Conclusions from Example 1

After seeing the comparative graph of these two scenarios, we can easily draw several conclusions:

- The first thing that immediately stands out is that there is a power hidden in TIME, which is capable of defeating even a double PROFIT. TIME is a lot like gravity to me. A seemingly weak force, invisible, but capable of boosting a spacecraft with such power as to send it beyond the solar system.

- The second thing that might strike you is that the first investor puts in very little effort to achieve what he achieves. Or in other words, TIME runs by itself and we don’t have to do anything about it. If it is used wisely, along with blowing out the candles and thinking that he gets older every year, the investor will notice that he also gets richer every year. A kind of compensation for the passing time.

- The third insight seasoned investors know, but newcomers may not, is this: Doubling your ROI from 10% to 20% on stock investments requires considerable effort. If we have to compare this effort to something, imagine a car that won’t start. The one aiming for 10% just pushes the car downhill and it boosts itself by momentum. And the one who aims at 20% PROFITABILITY has to push the car on an even surface to start it. Quite a different effort levels.

Let’s move on

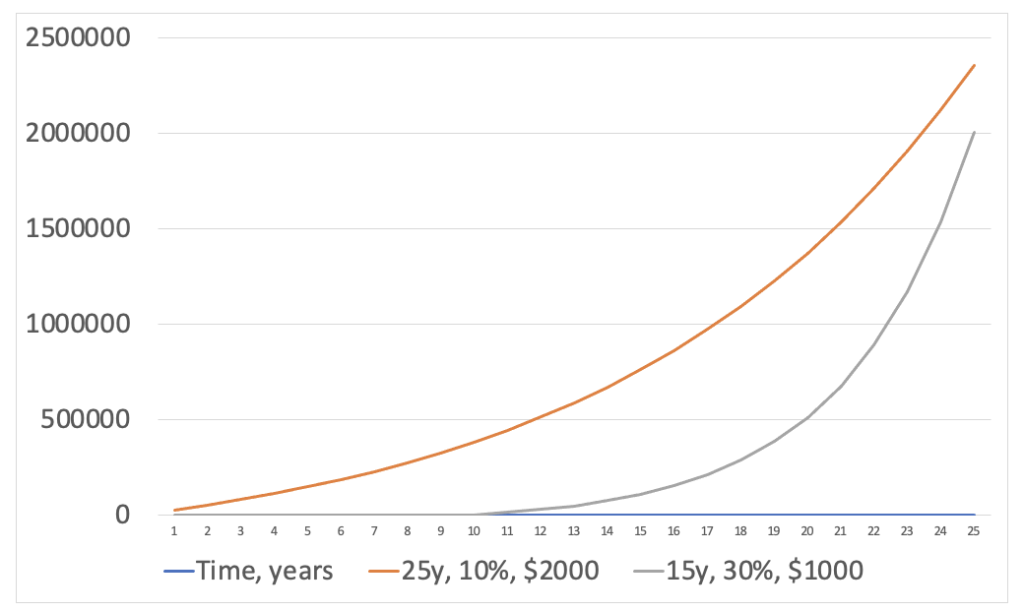

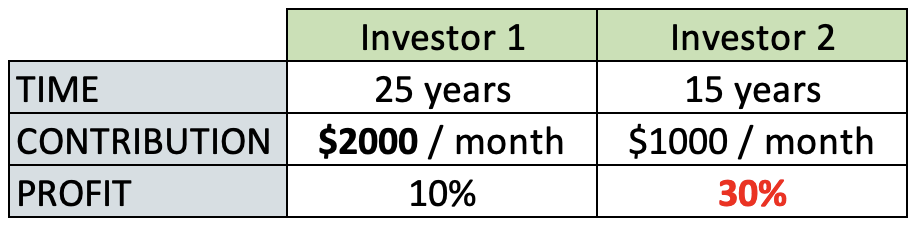

Example 2

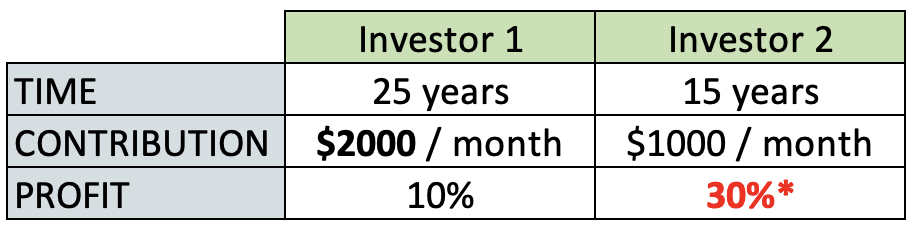

Now let’s play out a second example where the first investor is able to set aside a CONTRIBUTION of $2,000 per month for 25 years. He continues to be conservative in style, once again relying on natural forces to start his car

As you will see below, with proper reinforcement and enough TIME, his investment turns into a fortune of over $2,000,000.

The second investor is again the one who did not know in time that we should invest. He put his savings in a bank and over the years simply lost their value due to the effect of inflation. To catch up with his colleague, the right investor must increase his PROFIT, now to 30% per year. If he manages to achieve this, at the end of the period he will have a chance to almost catch up with his colleague again.

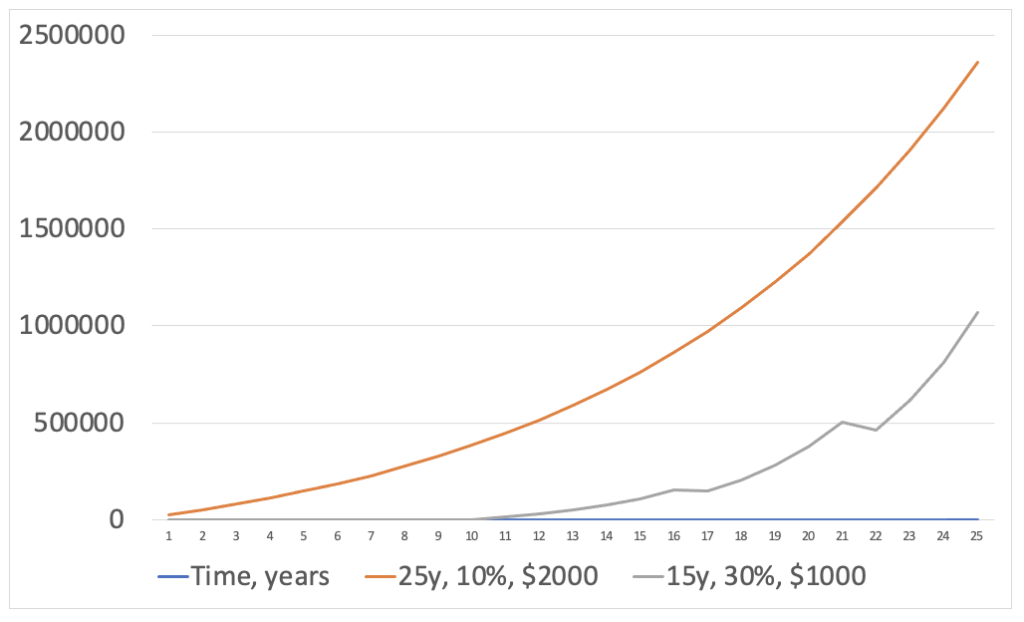

Looking at the visual expression of the tables, it’s easy to see that we can draw another conclusion about the power of TIME in addition to the first example:

- If we want to increase the outcome, instead of chasing high PROFIT, we can achieve the same effect by increasing the CONTRIBUTION.

In the previous example, we compared achieving a 20% PROFIT to pushing a stalled car on flat ground, which is quite exhausting. Achieving a 30% PROFIT, however, is like pushing the car up a steep hill. The efforts we will have to make for this activity are becoming downright overwhelming. Not only are we pushing up, but we will have to do it not just for a short time or once, but for the entire period of the investment, that is, every year of these 15.

And since pushing a car uphill for a long time is simply impossible, let’s look at the last example.

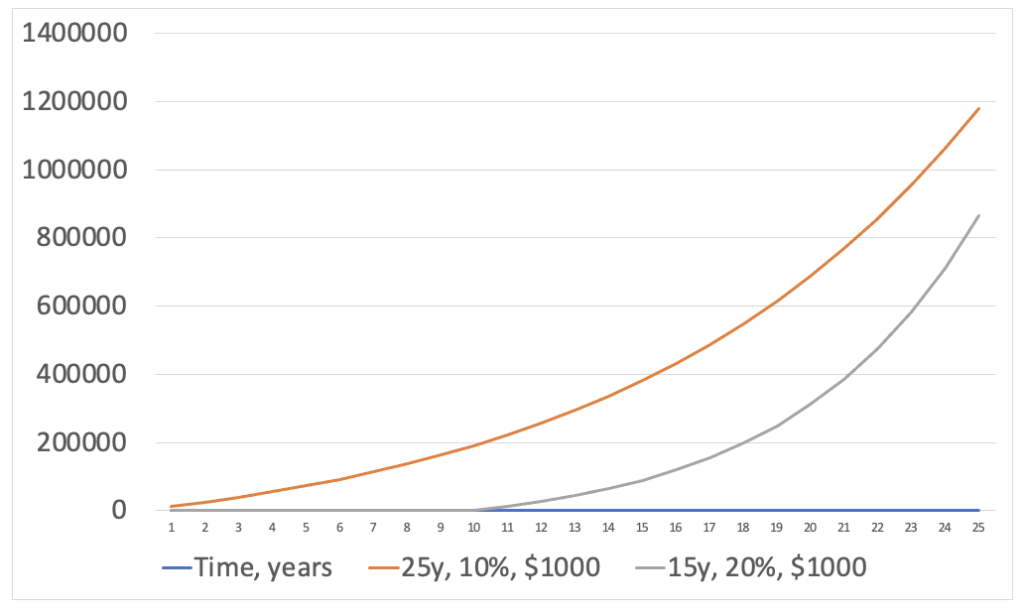

Example 3

There is hardly a single person on planet earth who has achieved an average RETURN of 30% per year for 15 years. At least there are cycles in the economy anyway that would require extreme agility, nimbleness and above all a flawless mind to stick to the constant 30% every year. So let’s make the circumstances a little more realistic and reflect on the result.

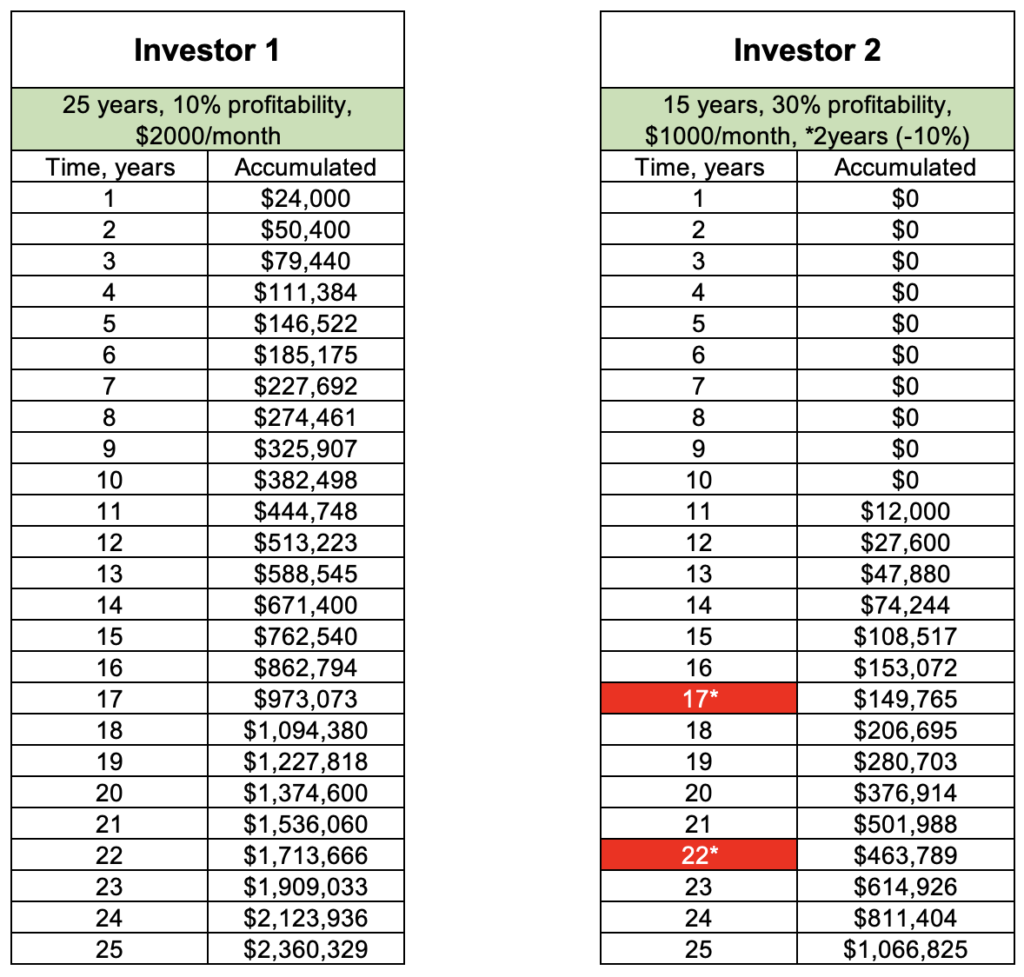

For both investors, there is no change in the monthly CONTRIBUTION, in the TIME of the investment and in the theoretical PROFIT. I have made only one correction compared to the previous example, and it is quite tolerant. As you will notice in the right table, Investor 2 instead of achieving a 30% RETURN in the 17th and 22nd years (7th and 12th for him), he or she achieves a negative RETURN of -10%. I say I’ve been nice to this investor because I sabotage his success in only two years out of 15. If he can make 30% every year without 2, it will again be a miracle, but let’s be hyper-optimistic and allow for that. But still, look at the effect.

It can be seen from the comparative graph that these two years prove to be detrimental to the second investor’s chance of even thinking of approaching the first. These stumbling blocks , although they may seem small at first glance, detract a lot from the speed gained. It’s like a Formula 1 driver blowing a tire. Even if he only has to pit for 10 seconds, when he comes out he will find that he is already overtaken by many of the other competitors.

Pushing the car up the 30% hill is impossible to do non-stop. Even the best investor will “get it wrong” and have tough years. The more risks are taken to achieve the high 30% PROFIT per year, the more the chance of backfiring increases. High-risk investments are like that for a reason. Even with the way we have softened this example, it remains difficult to implement in practice. It takes a huge amount of effort expressed in time, special skills and last but not least a great deal of chance.

I’m sure that after these three easy-to-follow examples, you can see that achieving our investment goals doesn’t require many stunts. If you want to set a higher goal or shorten the time to achieve it, adjusting the CONTRIBUTIONS component is the best approach. For instance, to reach your million not in 25 years, but in 18, you could increase your monthly contribution to $2000. If you want to achieve it even sooner—after 14 years—then raise your contribution to $3000, and so on.

The Psychology

However, before I end this article, where the math screams loud enough and the conclusions are drawn on their own, I will take a few more minutes. You know that for me the most important thing in the science of investments remains the psychology of investing. That’s where things begin and end. It is time to think about why everyone is rushing to the PROFIT component. I believe you’ll agree that understanding the reasons behind this gives us a better chance. It helps us combat the risk of losing balance by neglecting the other two components of success.

I will look at each of the components and try to analyze and classify it.

The time

TIME, or the period of the investment, we could liken to the wisdom of the investor. Anyone who has understood TIME and become friends with it has achieved high results not only in the field of investments. The musician who rehearsed every day becomes a virtuoso. The bodybuilder who lifted weights every day becomes an athlete. An investor who invests every day becomes wealthy.

It takes TIME for fruit to ripen, for wine to age. If we force TIME to squeeze faster results out of it, the fruits will be sour and the wine will not be able to develop its aromas.

TIME has the ability to amplify what we do. That is why it is necessary to set foot on the right path from the very beginning. A small error in laying a new road can lead to a deviation of 15 feet over time. By correctly laying the foundations of our investment strategy now, and understanding the components of success, TIME will amplify our efforts. In the future, we will harvest the rewards of our actions today.

“I wasted my time, now time is wasting me.”

Shakespeare

I jokingly say that if we don’t want to become characters from a Shakespeare play, we must treat TIME with the necessary respect.

The contributions

I see CONTRIBUTIONS as the discipline of the investor. It takes enough inner strength in each of us to make concessions from our comfort. Instead of eating, drinking, or otherwise spending all of his income, the disciplined investor makes the effort, endures hardship, and forms the habit of investing regularly, irrevocably, and relentlessly. CONTRIBUTIONS carry the spirit of freedom and the future.

The investor has the freedom to make a decision today that completely controls his future tomorrow. He also has the freedom to make that same decision every month throughout the investment period. In this sense, the CONTRIBUTIONS are also a responsibility. They represent the investor’s ability to overcome all obstacles that impede the monthly CONTRIBUTION. The investor must persistently reject all excuses, weaknesses, concessions, and explanations. This includes any reasons for not setting aside money to invest according to the original plan.

The profit

The ego

PROFIT is the ego of the investor. With PROFIT we can brag to our friends. With TIME, for example, there is no way. If you tell someone, “I’ve been investing for twenty years ,” they’ll shrug their shoulders and say, “I’ve been investing for twenty years too, so what?”. You can’t outrun him, you can’t show off. CONTRIBUTION seems to be also not the right component to compare with others. We perceive it simply as an act, not as a skill. We say, “It’s a matter of standard. “The wealthier can give more, the poorer less”. However, the decision to contribute more often involves skills that merit pride. These skills are the result of discipline and compromise, qualities that are truly admirable.

Illusion of control

PROFIT embodies the investor’s illusion of control. One of the most common misconceptions in the investment world is the idea that the future can be easily predicted. Much has been written on this subject and numerous social experiments prove that this is not the case and that tomorrow is in fact completely unpredictable. Misled by this delusion, we optimistically set our hopes and target riskier assets in search of higher reward. I recommend the books on this matter by Morgan Housel and James Montier.

Getting ahead of ourselves

We look at PROFIT as an opportunity to beat TIME or replace costly CONTRIBUTIONs. It represents the desire for things to happen today, and not as a result of long-term efforts and hardships. Or in other words we are rushed, impatient and in a hurry. Wealth is built up gradually over the years, not as a result of a sudden luck in the stock market. In our haste, we often take steps backwards and actually get there more slowly.

Many investors entertain the thought, “I’ll invest aggressively for a year or two to build up some funds, then switch to a conservative strategy.” This approach resembles gambling: “I’ll bet this $100 on red at the casino. If I win, I’ll walk away.” However, such strategies usually trap investors in one of two ways. Either they miss the mark, lose money, and lag behind conservative investors, or they win and feel validated as a “skilled player,” prompting them to continue risking. Inevitably, they often end up losing what they’ve gained, bringing them back to square one.

Finding Satisfaction in Patient Investing

I will end with the following: PROFIT is many more things – feelings, adrenaline, tension, stress. If you go down the path of seeking high PROFIT, you will go down a rougher and more winding road that will be filled with many emotions – both positive and negative. I will tell you from personal experience that it gives me much more pleasure to sit down and think about how to find funds to increase my monthly CONTRIBUTION, than to try to guess which company will perform better next quarter. The moment I find a way to allocate more funds and set my stockbroker to automatically invest them, I close the computer with a sense of satisfaction and pride. With the feeling that I have planted another seed in the ground and TIME will ensure it grows to a beautiful flower.