SHARE

Contrary to the usual topics I cover, this article will explore a specific investment opportunity I’ve been experimenting with for the past few months. As a reminder, I am not advising you to buy or sell any particular asset or to blindly follow my actions. My goal is to broaden your horizons and add another tool to your investing arsenal.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

Driven by a need to raise a certain amount of money within a year, I seriously considered how to ensure I met this goal. I weighed two options: starting an additional project for extra income or raising money through investment. Ultimately, I pursued both strategies. I’ll discuss the additional project in another piece, but here, I’ll focus on the investment strategy. It involves covered call options with an expiration date six months out and a strike price very close to the current level.

I will divide the text into three parts. What I planned, what happened and what I will do as a next step.

What I planned

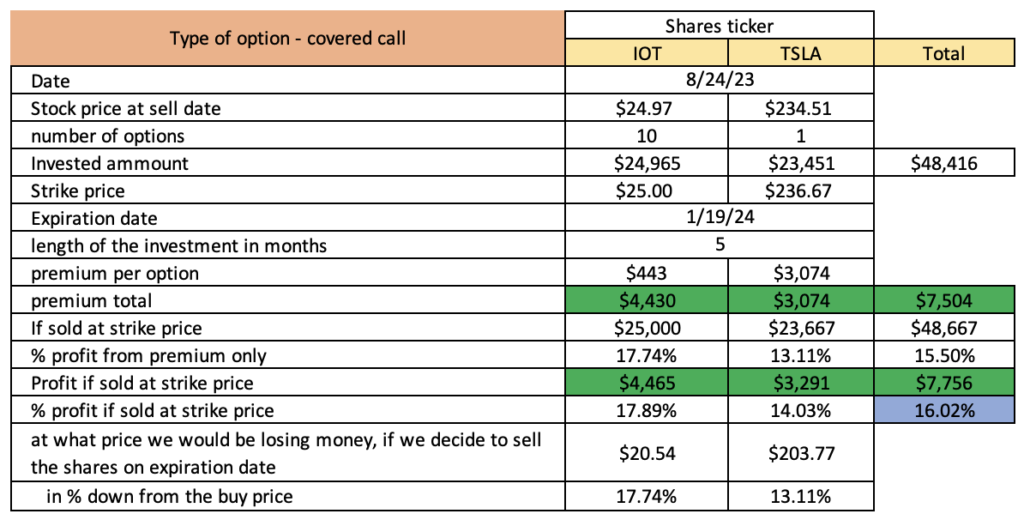

I started this initiative on August 24, 2023, sharing it in certain forums and among acquaintances. I selected two companies, expecting positive future development, bought their shares, and sold covered call options. These options expire in 5 months (January 19, 2024) with a strike price just above their purchase price (see specific numbers and details in the tables below). The potential candidates were TSLA (Tesla), IOT (Samsara), MSFT (Microsoft), SMCI (SuperMicro), NET (Cloudflare), and CSCO (Cisco). In the end, I settled on TSLA (Tesla) and IOT (Samsara), and I will share why them in a moment.

In my investing career, I have often sold covered call options, but never for more than a month. For those unfamiliar with options, especially covered calls, I recommend reading “Let’s make a bet.” Here, I’ll note that the main risk of this strategy is the share price falling below the strike price at expiration, preventing your shares from being sold. This means the stocks remain in your possession, delaying the outcome of whether you gain or lose from this operation until later.

Tesla

For the Tesla company, this risk does not bother me much, because I do not mind holding their shares indefinitely. I have invested in Tesla since 2015, I have a lot of confidence in them and I think that the company has reached such a level of development (9th by market capitalization to date) that it can afford to develop activities far beyond just selling cars . I’ve talked more about Tesla in the “The selection ” part of my 2023 Annual Review – “My Criteria and Methods for Company Selection” Even if it’s shares don’t sell, which is what I’m aiming for with this venture, it will be more than fine for me to stay with them and watch the price in the months to come.

Samsara

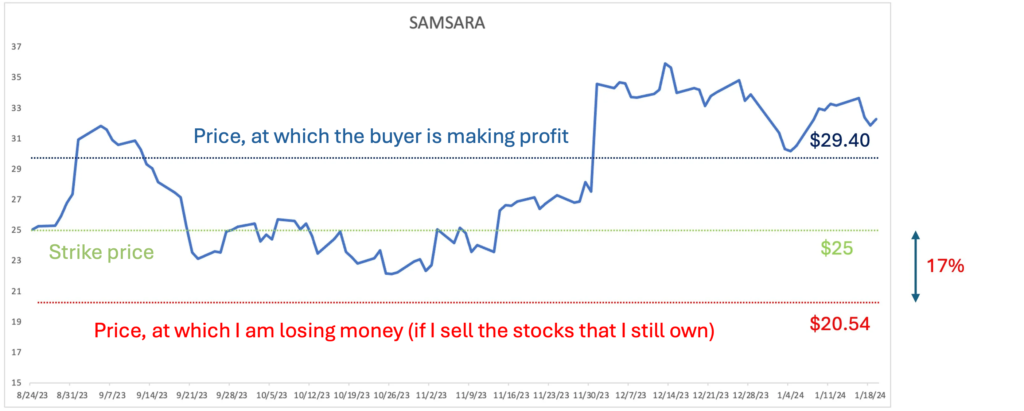

Despite my confidence in Tesla, to diversify, I decided to include one more company. Samsara has been part of my investment portfolio since the spring of 2023. Which means, I’ve been following the company very closely for a while anyway. Until the sale of this covered call option in August 2023, the financial statements they presented were good and gave the impression of optimistic future expectations until the end of the year. This gave me confidence that the year would end well. This expectation was subsequently confirmed when they delivered magnificent reports in late August, just days after I sold this option, and again later in November.

Here are the numbers as originally planned. As seen in the table, the investment includes 1 covered call option on Tesla and 10 on Samsara. The strike price is set slightly above the current price, with the high likelihood it will be exceeded during the long five-month period until expiration. A development I actually anticipate. Often, people sell covered call options intending not to surpass the strike price. They aim to collect the premium, keep the stock, and possibly repeat the trade. This strategy is more predictable and feasible when the expiration date is just a few weeks away. However, over a longer period, one might expect the stock to pass the strike price, leading to the exercise of the option and the sale of the stock.

table of the planned investment

Beyond the specific numbers, graphs and final results in the text, I will also touch on three topics that are close to the usual that I like to talk about. Namely – from the world of psychology and emotion in investing. I will talk about the attitude and the way we look at a specific investment . A topic fundamental to our success in investing in general. I’m going to address the risk involved in this investment and something I’ve been thinking about lately – what I call The niche of the moderate risk. And of course, I will remind you that one of the functions of money is to make more money. We’ve talked about this before.

The attitude

In this venture with covered call options, I accept the possibility that the strike price may be exceeded, which is part of my strategy. I am content with the premium received when the option is sold and choose not to worry about potential lost profits from additional growth above the strike price. By placing this bet, I commit to a maximum return of about 16% over 5 months. This mental setup is crucial for me.

By accepting this return and emotionally preparing for no regrets over any lost profits, I simplify my emotional investment. Experienced investors understand the critical role of emotional state in investing success. With this specific investment, many of the parameters are fixed from day one, allowing us to observe rather than being able to change the situation.

The niche of the moderate risk

At first glance, the projected return appears low and would be overlooked by many serious stock investors. When I shared this idea, I heard opinions that the idea is good, but there are better opportunities to realize higher profits. This got me thinking about what I now call The niche of the moderate risk. In my conversations with known investors and following investment forums, I notice mainly two groups of investors. Some follow a highly conservative investing, relying on returns from funds tracking broad indexes, thus aiming at about 10-12% returns per year. The others – risk investors – maintain very aggressive portfolios in search of higher returns. It seems that the initiative that I am taking with this venture falls somewhere in the middle between the strategies of these two groups and opens up opportunities.

At first, like we said 16% return isn’t much, but if one bothers to do the math, 16% over 5 months is actually about 38% per year. Not a bad return at all. I am sure you will agree.

Why I think the risk on this investment is moderate. For the following two reasons:

Reason 1

On the one hand, in this type of investment, I reduce long-term risk by selecting companies whose shares I would feel comfortable staying with if their price remains below the strike price at expiration. I tend to hold their stock in case of a temporary dip. All that needs to happen for me to earn the full premium is for them at some point to return to the price I bought them at at the start of the investment.

Reason 2

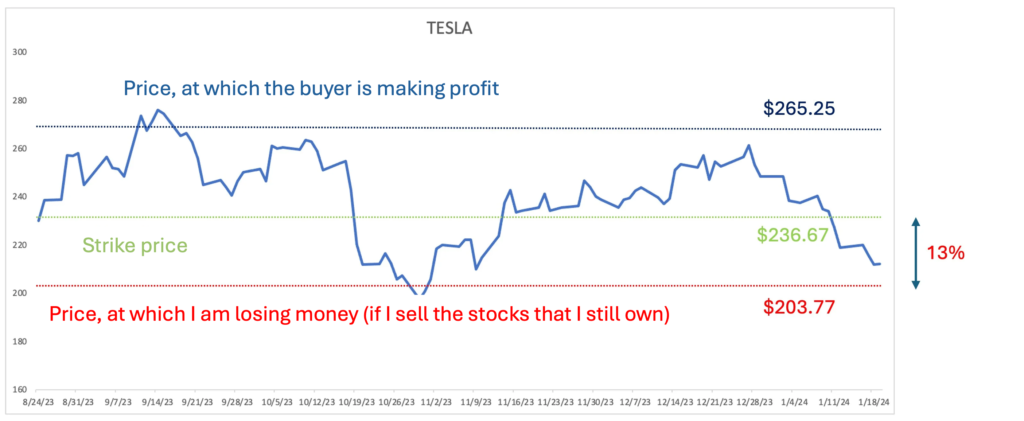

A second reason for the reduced risk is the premium that I receive at the very first moment of concluding the transaction. It is a buffer that allows me, even if I decide to sell the share below the strike price on the expiration date, to still make a profit, even if it is lower than planned. In the particular example, at any Samsara price above $20.54 per share and Tesla above $203.77 this investment will be profitable. That’s why, when selecting shares for such a transaction, it makes sense to take into account this downward percentage, and it is no coincidence that I carefully calculate it, and it is one of my criteria for selecting candidate companies for this investment. For Samsara it is about -18%, for Tesla -13%.

That is, companies with a bigger premium give me a bigger buffer and more peace of mind. And larger premiums are actually paid for companies that are more certain to increase their price significantly in the future. Which is also what I want.

Money has the power to generate more money.

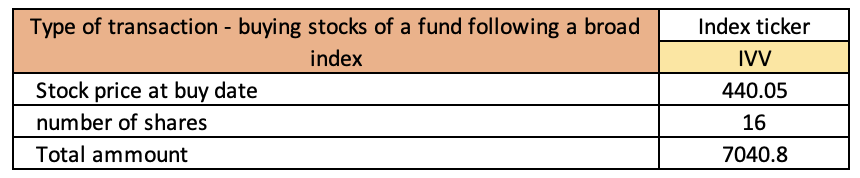

To apply the rule that money makes more money, I choose not to bank the premium from the call options. Instead, I reinvest it in a fund that tracks the S&P500 index. I expect the fund to pay dividends twice over the next five months. This strategy aims to maximize profit. When the options mature, I plan to sell the fund shares and calculate the total profit percentage.

additional investment table

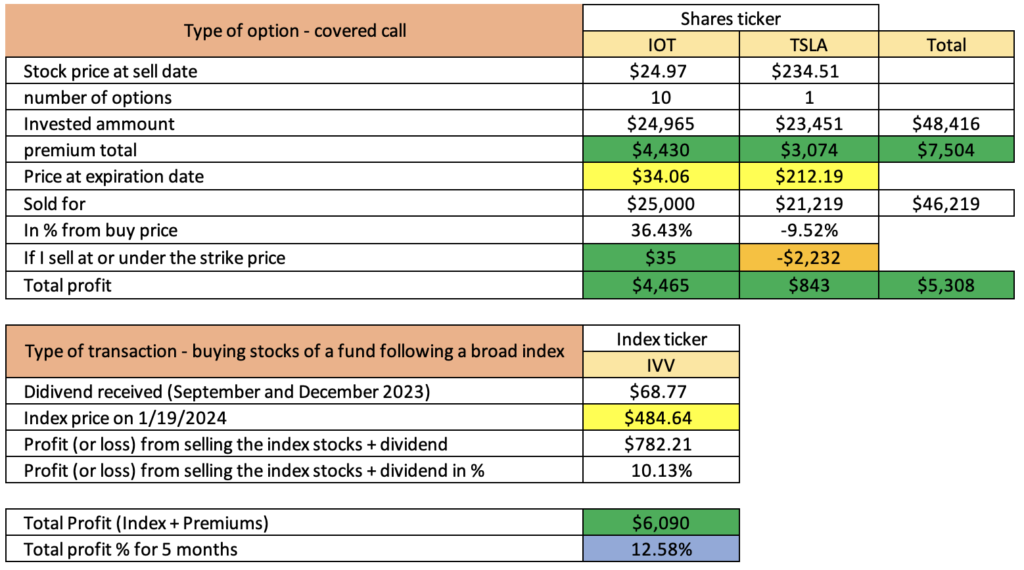

The outcome

As can be seen in the table below, the result of the venture is 12.58% return for 5 months. Samsara’s option was exercised and the stock sold at a strike price of $25 per share. The Tesla option was not exercised and the shares remain in my possession. What options I have and what I will do with Tesla, will mention in the last part of this material.

final outcome table

I made an interesting observation, in my first time issuing such a long-term option. I noticed that although both stocks remained above the strike price for a long time, the buyers of my options chose not to exercise them.This logic holds because if they exercise the option at the strike price, they would still incur a loss once they factor in the premium they paid me. Remember, their bet depends on the stock rising significantly more. Now, let’s examine what happened with the two options during this period, starting with Tesla.

Tesla

Tesla price chart

The buyer was in profit only briefly, at the start of the option period. He could have exercised the option but chose to wait. By the expiration date, he had not bought the Tesla shares and lost the chance to at least partially take back some of the money he paid for the premium. As the seller, I profit from the premium, minus any difference between the purchase and sale prices of the stock if I choose to sell at the expiration date. The buyer likely did not anticipate Tesla’s drop below the strike price in the final days of the year and the beginning of the next. Had he expected this, he might have exercised the option to recover some of the premium.

Samsara

Samsara price chart

The situation with Samsara is different. The buyer had been in a profit position for long periods but did not exercise the option until the expiration date. I was curious about the possible reasons for this. Understanding these reasons helps me grasp the entire mechanism and strategy of this long-term options initiative. My research suggested several plausible reasons. They essentially boil down to the buyer being bullish and betting on further price rises. He or she seeks higher profits rather than settling for lower ones, adopting a strategy that involves more than moderate risk. At expiration, both the buyer and I profit—the buyer from the stock’s potential and I from his premium. Interestingly, he earns less than I do initially, but now owns the stock and could earn more depending on his next moves.

Ultimately, the fact that the buyer didn’t exercise the options earlier in the investment period means that my invested money was tied up in this deal for 5 months. If they had exercised the option earlier, I would have immediately invested them again, probably in a similar scheme. This is something I feel is important because now I know that in the future I cannot count on an early sale or it would be rare.

Setting your brain in the right frequency

I think it’s also important to note that both sides of this deal are looking in the same direction and betting on a rising stock price. However, as long as the buyer bets on a significantly higher price than the day of the trade to make a profit (the blue dash), I am perfectly happy.

I am fine to receive only the premium and ignore all other possible, probable, improbable, imaginary, and dream potential benefits. For example, in the case of Samsara, if I buy shares at $25 and sell them today at expiration date at $32, which is their value, I will get a 30% return instead of the 12% total that the trade achieved. But by creating the right mindset and emotional setup, it doesn’t bother me and it’s not my goal. Thus, I enter the niche of the moderate risk and try to profit from the greed of others seeking higher returns.

Certainly, there’s always a better investment, and there are always opportunities that we overlook. However, abstracting from such thoughts, I can be happy with a set and achieved goal that does not push a plan to the maximum. If you imagine yourself making this investment in the form of:

I took money -> made more money with it -> returned the original money, you shouldn’t be too much regretting potential alternative scenarios.

What choices do I have now?

It remains to share my plans from now on. Samsara shares will be sold at the strike price. There is no doubt about it, and on Monday, January 22nd, I will discover that. It’s also pretty clear that Tesla stock isn’t going to sell. Therefore, I have two options on how to deal with them:

- I can sell them at the price they’ll be at on Monday, January 22nd, the first day after the option is released, at the market’s opening price. Thus securing the final return on this strategy.

- The second option is to hold the stock and wait for the price to go back up to where I bought it to realize the full premium.

I will prefer the first option. As I have said several times, I would like this investment to be less about the movement of the share price than about the premium being paid and the demand for moderate income. I own Tesla shares as part of my portfolio anyway, the purpose here is different. The company is due to release a quarterly report on January 24th, which could send this volatile stock reeling hard in one direction or the other. For the purposes of my current investment, I believe I have achieved my stated goal.

In the long term, I will repeat this exercise again with an expiration date of June 2024, again with 2 or 3 companies. They could be the same or different. The buffer I will get from the new premiums will add to the profit from this strategy to give me peace of mind and margin for error. My goal will again be to invest in the moderate risk niche.