SHARE

Introduction to Investment Perspectives

I have been gathering the emotional strength to write this article for quite some time. The topic is multi-layered, touches a lot of feelings and causes heated arguments.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

The Challenge of Beating the Market

How do I find the courage to tell people that what they’ve been doing for years doesn’t make sense? It’s like calling out, “Let’s shut down all investment forums, stop all discussions, put down the books you’re reading, and stop all attempts. “You can’t beat the market ! Why do you keep trying? Invest in a broad index and go do something else.”

But who would believe that anyway? Does such a statement make sense and is it even useful to anyone? Shouldn’t we all go through a similar stage in our investment development, like we’re kids learning to ride a bike and having to skin our knees to learn? And finally , who am I to give such an assessment, as if with my statement I make it a complete and categorical fact? These are the thoughts that run through my head and cause a lot of feelings in me… because I’m like you. I am also trying to beat the market…

Investment Philosophy for Beginners

The purpose of this article is not to discourage anyone who has embarked on this path, nor to ridicule or attack such attempts. The goal is to provide enough information especially to people who are just starting out with investments.

The typical profile of a newcomer to the investment world is the following. If they are people who earn their money with a lot of hard work (most of us), they approach the idea of investing in the stock market carefully, slowly, even with distrust. At the very beginning, they very correctly focus on more conservative investments that do not require much effort, bring decent returns and where the risk is moderate.

But as the saying goes, “Appetite comes with eating.” They suddenly switch to actively managing their investments and correspondingly try to outpace the market. Quite naturally, sooner or later, they get cut, mostly because they don’t know and don’t understand their chances, just as many roulette players don’t know that for every $100 the casino takes a little over 5 (house edge). These people make a leap in their investment actions without making a leap in their knowledge. And accordingly, the market, that is, the other participants, punishes them.

I intend to divide this text into three parts, the first of which will deal mainly with clarifying the essence of the matter. The second will look at the emotional reasons why we make attempts to beat the market, and in the third, which I think is the most interesting, we will talk about why it is difficult to succeed.

The essence of the matter

Since not everyone is a seasoned investor, and many of you are now treading this territory, it’s only right that we begin by answering two basic questions:

1. What does it mean to “beat the market”?

2. Why is the question “Are you able to beat the market?” not correctly asked?

What does it mean to “beat the market”?

Let’s tackle the first question. Getting ahead of the market in the most general sense means achieving better returns by picking your own investments versus investing in a fund that tracks the economy as a whole. In the article “Nik, tell me how to invest” I advise novice investors to invest in funds that track the S&P500 index, which reflects the movement of 500 large companies of the American economy. Historically, this index has achieved between 8-10% returns per year. Trying to get ahead of the market means only one thing – not agreeing to get 8-10% returns per year on your investments, instead – aim for a higher yields. Let’s use a metaphorical example to explain.

Beating the traffic

Imagine two people leaving for work in the morning. One gets into the car and drives away calmly. He knows that given the traffic at that time, it will take him an average of 45 minutes to get to work downtown. He puts on his seat belt, sips his coffee, and calmly sets off on his usual route. However, his neighbor, a colleague, does not agree with him traveling 45 minutes. He is bored, and why did he buy a Mustang if he will have to drag himself along like “everyone else”.

The first thing he does when he gets into the car is to check all the possible routes on the GPS and choose the one with the least traffic. He chooses and drives off. However, unlike his colleague, his driving style is different, and he never takes coffee in the car because it will spill anyway. Instead of moving with the traffic, the driver of the powerful car does all kinds of pirouettes and tricks, constantly moving left and right along the freeway lanes, with the idea of getting there faster, ahead of the traffic. Whether he succeeds in doing so or not, we won’t discuss because we don’t know, but it gives us an opportunity to reflect on some issues that I’ll talk about in a moment.

Why is the question “Are you able to beat the market?” not correctly asked?

Let me now turn my attention to the second question – “Why is the question “Are you able to beat the market?” not correct? Now that we know what it means to be beating the market, our answer should be very simple. If we do, we answer YES. If we don’t, we answer NO, right? In our restless driver example with the Mustang – if he got to work earlier, then he managed to beat the traffic, and if he got there after his calm colleague, then he didn’t. But when asked like that, the question is not correct. And this incorrectness bothers me personally, because the question is often discussed incorrectly and distorts the conclusions.

However small the difference may seem at first glance, it is significant and is the key to the whole article. What many people miss when asking the question ‘are you able to beat the market?’ is the word “consistently“. Let’s ask the question again, but this time correctly.

“Are you CONSISTENTLY beating the market?”

Consistency

Do you consistently manage to get to work early by driving like crazy through traffic? If you look at the balance sheet at the end of the year – out of 240 working days, how many of them do you manage to arrive early? Because after all, if 40 times a year you manage to arrive early, but the other 200 you are late, then you are not able to beat the traffic. And in the end, you cannot claim such a thing, and your answer must be NO.

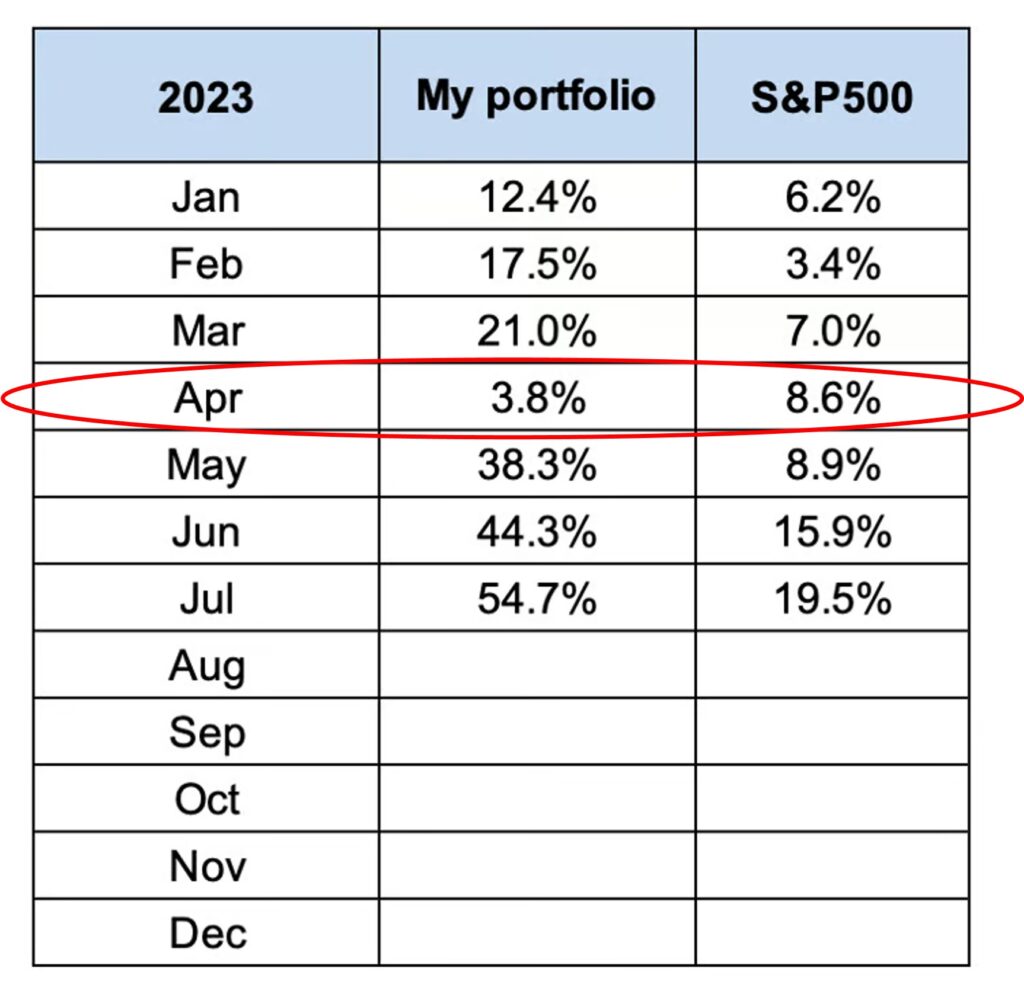

If someone asks me this question, I can answer them with the table below, which is my current yield so far (2023). As you can see, for this year, except for the month of April, the answer is YES. But whether it will be YES at the end of the year, I don’t know yet. But please don’t ask me what the situation was last year (2022). I prefer to keep quiet. So selectively, depending on what I’m aiming for, who I’m talking to, and what I want to prove, I can carefully pick the period and confidently say that YES, for that period I’m definitely ahead of the market. So do many other people for whom it is important to convince others that they are ahead of the market. And why this is important for them, we will see in a moment.

my portfolio as of July 2023

The difference between being able to beat the market today and being able to beat the market in general is like throwing a paper airplane and have it fly 6 feet and landing a spaceship on the moon. Anyone can beat the market, just as anyone can bet once on red when playing roulette and win. There is no doubt about that. The difficulty lies in consistently being ahead of the market, day after day, year after year, which is extremely difficult, and proven to be something few people manage to achieve over the course of their investment career. And there are reasons for that, which we will deal with in the third part of this text.

The Long-Term Perspective

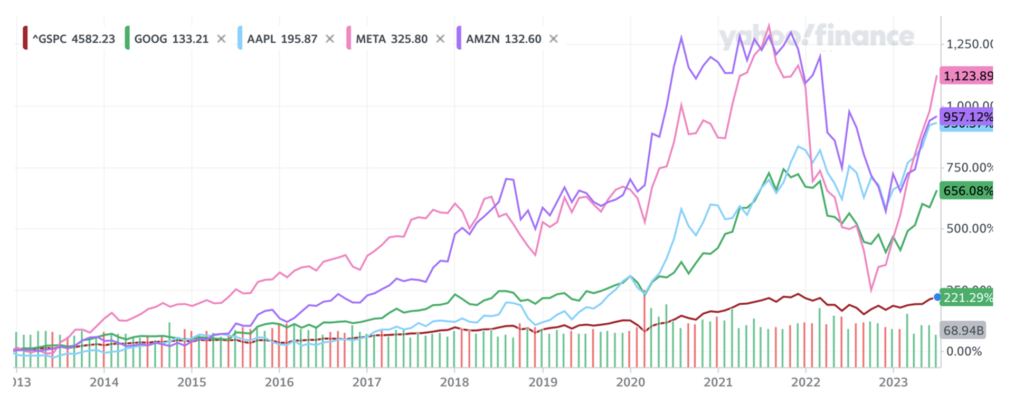

Contrary to the claim that beating the market is difficult, if we take the period of the last 10 years, anyone who, instead of buying a fund tracking the S&P500 with all their money, bought one of the tech giants, Google, Amazon, Facebook, or Apple, or even a combination of all four, he or she will have outperformed the index by between 3 and 6 times. Anyone who has done this can say that YES, they were ahead of the market for a 10-year period. And while such an action seems like a good idea to us at the moment, we think so only because we look back in time.

And we’re probably looking selectively, turning a blind eye to all of 2022 when these stocks crashed, setting such investors back years. What single stock would you bet all your money on right now to beat the market in the next 10 years? There is hardly a single investor in the world who would do such a thing. Because it is absurd.

A comparison price graph of the % raise of the broad index S&P500 vs Google, Apple, Meta and Amazon for the last 10 years.

The Cost of Ambition

Of course, just because something is difficult in no way means that we shouldn’t try to do it. Sometimes the pleasure and satisfaction are precisely in succeeding in something difficult. I imagine that’s one of the main reasons we’re making these continuous attempts. But it makes sense to think about something else. What is the price we pay or are we willing to pay to achieve this goal? Everything in life is a compromise, a trade-off. What do we have to give to achieve this difficult task of being ahead of the traffic or ahead of the market? How much risk are we willing to take on this?

The attempts of our known aggressive driver to get there before his colleague – at what cost? How many times has he been pulled over by the police for speeding or improperly overtaking? How many times has he come close to causing an accident and never made it? Would it benefit him to save 1 minute 239 days a year, but on the 240th he crashes his car and it goes to a collision repair shop for a few days and he at that time uses public transportation and travels hour and a half?

The price we pay for trying to get ahead of the market

Increased risk

Having given up on the tame (8-10% returns per year) and chasing the wild, we are taking more risk. If we are drivers, instead of arriving early, there is an increased possibility to be actually late. And when we talk about our investments, not only we may not make the 8-10% largely guaranteed with passive investing in a broad fund, but we may also lose money.

Time and energy

We invest considerable time in reading, studying, researching, and building portfolios. We closely monitor information about the companies we own and engage in continuous technical analysis, as well as frequent trades, depending on our chosen strategy.

Concentrated portfolio

We manage concentrated, instead of diversified a portfolio that is more volatile, meaning it suffers a sharper and more sudden change in price, than a fund tracking a broad index. Accordingly, we are more vulnerable to changes in the prices of the assets we have selected.

Biases and traps

We are more susceptible to behavioral patterns and more easily fall into traps that lie in wait for us .

Stress

Increased levels of stress. Something we rarely account for.