SHARE

4. Invest in the Economy as a Whole

Discussing the stock fund I mentioned earlier, which constitutes the bulk of your investment, it’s important to understand what a stock fund is. Essentially, it’s a collection of stocks from various companies bundled together under one investment. There are different kinds of funds based on the types of assets they include, like technology or financial sector funds. Then, there are those that cover a wide range of sectors. Opting for a fund that includes a broad spectrum of companies helps diversify your investment. This diversification lowers the risk of any single asset’s performance significantly impacting your overall investment. Essentially, by investing in a diverse stock fund, you’re not just spreading your risk across different asset types. You’re also spreading it across numerous companies within the stock market. This approach ensures you don’t have all your eggs in one basket, contributing to peace of mind.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

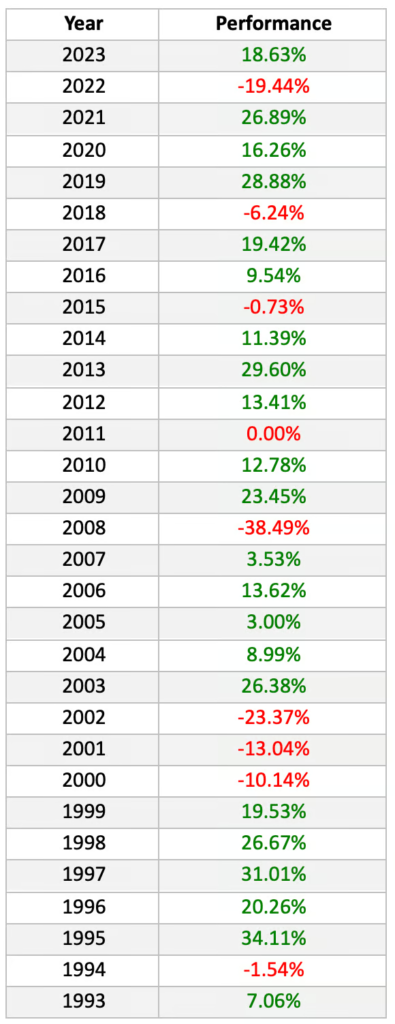

Remember, diversification has a trade-off. While it mitigates the risk of significant losses, don’t expect astronomical gains. Investing in a fund that tracks the overall performance of the US economy aligns your investment’s growth with the average growth of that economy. Historically, this means an average annual growth rate of about 8-10%. Some years might see higher growth, while others might see little to no growth or even a decline.

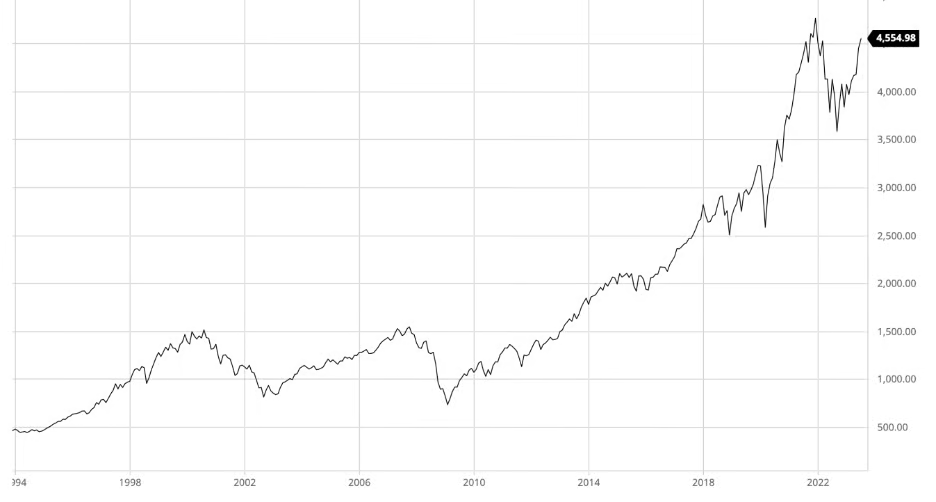

Consider the S&P 500 index, which tracks 500 large companies in the US. Over the last 30 years, it has shown overall growth despite significant downturns. These downturns include the dot-com bubble, the 2008 financial crisis, the Covid-19 pandemic, and more recent economic challenges. While impactful, these downturns have been temporary. The index has recovered over time, benefiting those who’ve invested in it for the long haul.

S&P500 for the last 30 years

However, the risk becomes more pronounced if you’re investing with a specific time frame in mind. If you need to withdraw your investment during a downturn, you might face losses. For instance, if you’re saving for your child’s education and plan to use the investment when they turn 18, a market downturn at that time could affect the investment’s value. Yet, typically, market lows don’t last very long. Investing regularly during these periods can enhance your returns. This makes funds that track indices like the S&P 500 a moderate and conservative investment choice.

For those interested in investing in a fund that tracks the S&P 500, options include IVV, SPY, and VOO, among many, many others. The differences between these funds are minor, and you may discover others that fit your investment strategy.

S&P 500 performance per year

5. Invest regularly and discipline yourself. Reinvest dividends.

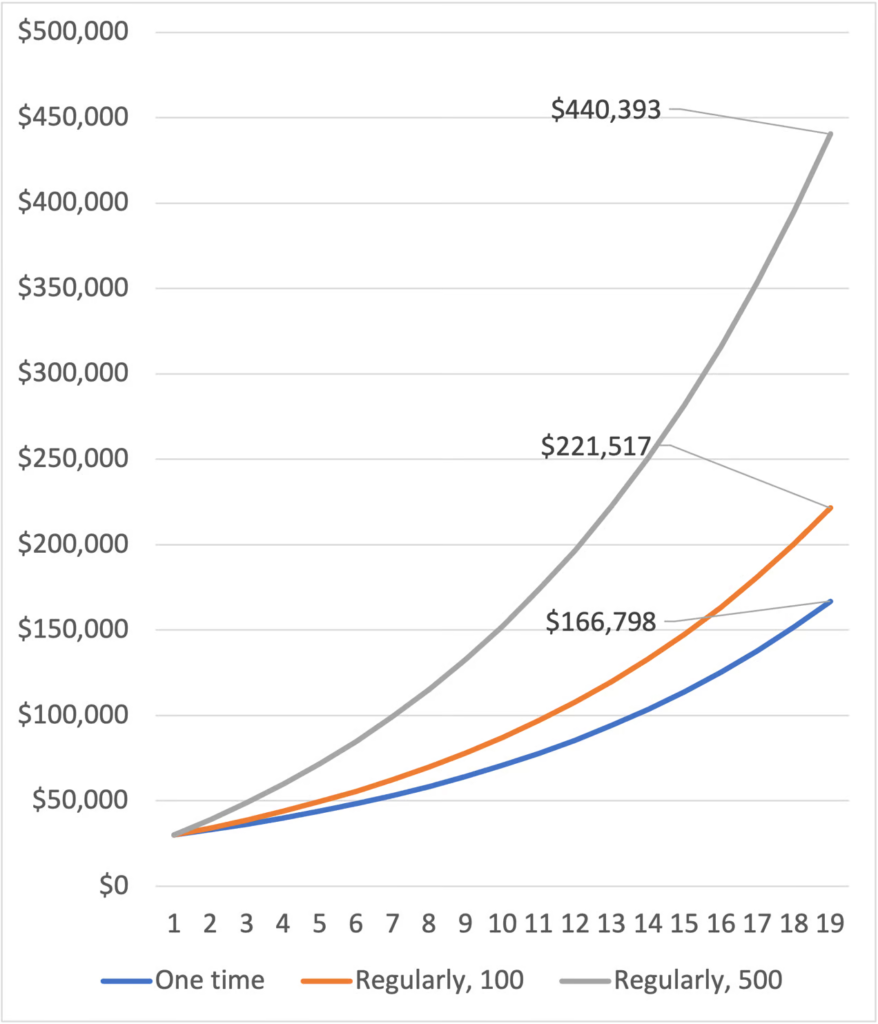

The foundation of this step is the discipline to invest on a regular basis. You might initially think about investing the money you’ve saved, but it’s crucial to go a step further: regularly set aside a portion of your income for investment. Monthly investments are practical, aligning with most people’s pay schedules. No matter the amount, the impact over time will be significant. Even saving $100 monthly, given the power of compound interest, can grow substantially over 18 years. Online compound interest calculators can illustrate this growth. For example:

If you invest $30,000 at the birth of your child, assuming an average annual return of 10%, and never add more, by the time they turn 18, your investment could grow to $166,000 without any additional effort.

Adding just $100 every month to the initial $30,000 could see your investment grow to $221,000 after 18 years.

If you can invest $500 monthly on top of the initial amount, the investment could reach around $440,000 by your child’s 18th birthday. This would give them the option to attend prestigious and costly colleges like Harvard, Stanford, or MIT.

Graph illustration showing the growth of investments over time

These calculations are not fantasies but are based on mathematics and your discipline to invest regularly. Many stock brokers offer automated investment options, allowing you to invest regularly without manual intervention. You set up automatic withdrawals and purchases through your brokerage app, and over time, your investments grow alongside your future plans.

This approach embodies the investment strategy known as dollar-cost averaging. This strategy involves regularly purchasing your chosen asset, which works well even during market dips. By buying a fixed dollar amount on a set schedule, you purchase more shares when prices are low and fewer when prices are high, averaging out the cost over time.

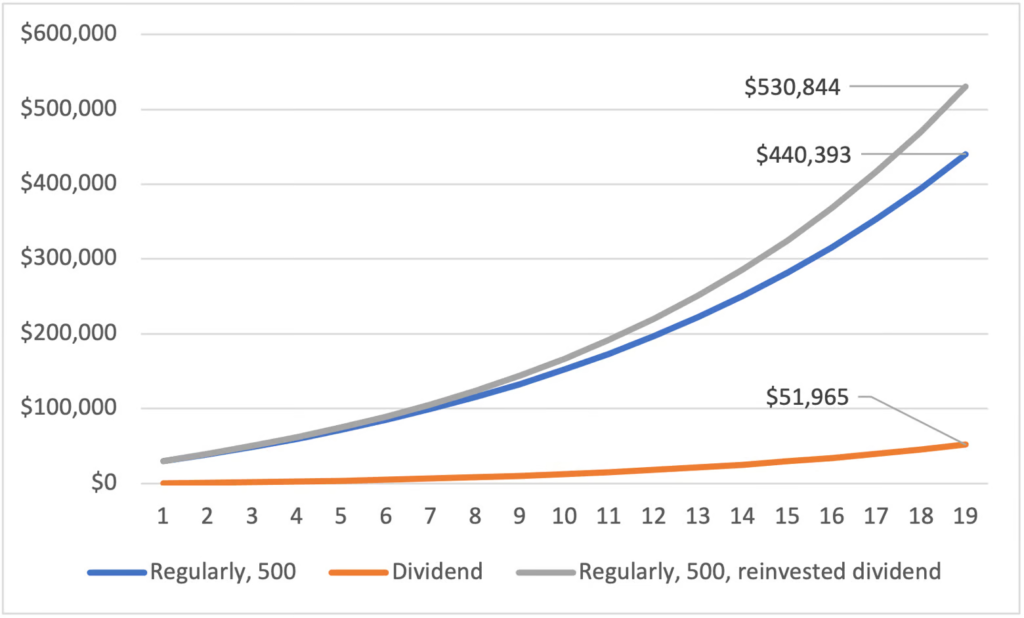

Investing in funds, like those tracking the S&P 500, also yields dividends, which can be thought of as a bonus for holding the fund. While dividends might seem small at first, around 1.5%–2% annually, they add up, especially when reinvested. For instance, if you invest $10,000 in a fund with a $450 share price and an annual dividend of $6-7 per share, you’d earn about $140 annually. This might seem modest, but reinvesting these dividends amplifies the benefits of compound interest over time.

Reinvesting dividends means using them to buy more shares of the fund, further increasing your investment. Over 18 years, the effect of compound interest means these dividends grow beyond a simple yearly addition, significantly boosting your total investment.

A graph showing the difference between reinvesting the dividends and not doing it

For example, reinvesting dividends from an initial $30,000 investment could add an additional $40,000 to your portfolio over 18 years, compared to not reinvesting. This strategy, combined with regular investments and compound interest, can transform your financial future. It turns a steady stream of small contributions into a significant sum.

6. Don’t keep track of things regularly. Forget about that money for the duration of your plan.

This advice might sound odd, but it ties closely to the emotional aspect of investing, which merits a detailed discussion. For someone just starting out, who prefers not to dive too deep initially, I recommend investing in a broad fund. Make regular investments and reinvest dividends. This process can be entirely automated, requiring just an hour or two to set up. After that, you can essentially forget about it. Jokingly, you might set a reminder for 18 years in the future to check on your investments, but there is truth to this approach.

Dealing with investments can trigger a wide range of emotions, including greed, fear, worry, pride, arrogance, panic, and despair. If you’re not planning to actively change your strategy or delve deeper into financial education, obsessively monitoring your investments can provoke unnecessary emotional turmoil. Let those emotions rest and allow your investment to grow quietly in the background. Constantly checking its progress is like checking every ten minutes to see if a planted seed has sprouted—it’s unnecessary and can lead to impatience and frustration.

I’ve emphasized choosing a fund that tracks a broad index for investment, either as a lump sum or through regular contributions. This simple strategy can be surprisingly effective, often outperforming more active investment approaches. The temptation to meddle with a smoothly running system can be strong, especially after a particularly good or bad year. You might regret that probably you should have invested more during the good times or consider selling off during the bad, forgetting that the plan was for an 18-year investment horizon, designed to weather the ups and downs.

In summary, for those matching the profile we’ve outlined, sticking to the discipline of these recommendations is crucial. If you’re inclined to expand your knowledge and delve deeper into the world of investing, that’s commendable. However, I suggest letting the investments for your child’s future follow this plan undisturbed. If you wish to explore more actively, consider starting a separate portfolio. This allows you to engage with the dynamic and emotionally charged world of investing without jeopardizing the steady growth of your initial, long-term investment.

7. Technical guidance on how to start investing.

Now, let’s discuss the practical aspects of where and how to start investing. There are many well-known stock brokers. You might want to Google to find the best one for you, or a friend could recommend one they use. Each broker has its own interface and features. However, managing your investments through a smartphone app has become straightforward, making it accessible for anyone. Setting up and navigating these apps is not overly complex; you shouldn’t need more than an hour to get familiar with them. Most stock broker apps offer the functionality to automate regular investments, pulling funds directly from your bank account, and to reinvest dividends, as previously mentioned.

However, it’s crucial to conduct your own research to ensure confidence in your chosen broker. Questions to consider include: Are they reputable and legally operating? Can you easily manage and withdraw your funds? Is the process of transferring money between your bank and the broker straightforward? And importantly, can you designate a beneficiary in case something unexpected happens to you?

Concerns about fees are valid, but typically, the charges for buying assets are not so significant that they would impact your overall investment goals adversely.

With this information, I conclude my article and wish you success in your investing journey!