SHARE

This article is a related to my 2023 year end thoughts – “Luck, skill or something else”

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

Portfolio Selection Criteria

Moving on to the second part where I will talk briefly about some of the companies in my portfolio. Without going into depth about each one individually, the aim will be to get an idea of the criteria I use for selection, as well as my approach in general. I wouldn’t want to impose any opinion in any way, but I’m sure you’ll find some thoughts of mine that would be helpful to you in building or reinforcing your strategy.

Investing in Cloudflare: A Long-term Holding

Cloudflare is one of the stocks that lasts the longest in my portfolio. I first invested in it in 2020, just a year after it went public. I admit that this company also has some sentimental value to me, because by coincidence I visited their office (the only one at that time) back in 2013, when the company was a very small startup and the employees worked 10 people at one desk in a small, private room in complete disarray.

Key Investment Criteria for Selecting Companies

Something that is important to me, although I do not know the three founders personally, I have watched their interviews. I like them and trust them. I have to like the CEO to vote confidence and money in the company he runs. Cloudflare is a part of the technology sector and generally speaking it deals with internet services, internet security etc., activities important and necessary these days. You may not know, but often when you visit a website, your request goes through the company Cloudflare, which delivers the website’s content and filters the traffic. They are a leader in this activity. I don’t want to go into technical details, but here are some of the other criteria I use to choose a company and in particular Cloudflare to be part of my portfolio:

- how critical the company’s services are to the success of its customers,

- how unique is the service they offer in the market unique

- how hard they can be replaced by their competitors

The SaaS Business Model: Scalability and Predictability

Cloudflare is a typical example of a SaaS company (software as a service) business model. One of the advantages of SaaS companies is that just as an author writes a book once and then sells it many times, these types of companies build some software, application or service that they can then sell many times without the same technology costs of its making. In this way, the company has the opportunity to grow much faster than a typical refrigerator manufacturing company, which in order to double its size must produce and sell twice as many refrigerators. It is for this reason that many of the technology companies with a tradition of making hardware are looking to switch to this model and become software companies.

Another advantage of this type of business strategy is that long-term contracts are usually made with the customers who pay a subscription. That is, very well predictable are the incomes and profits of such a company for a future period, because they are guaranteed for several years because of the subscriptions.

Financial Health: A Top Priority

Of course, quarterly financial statements are fundamental and most important for me to decide whether to continue betting on a company. Just because it follows a SaaS business model is by no means enough to be successful. The company may be poorly managed, not looking for development in new segments, not creating new products, not developing the trade well or in other words failing to sell its products, as well as having such competitors as to suffocate its activity. What I look at most often in the financial statements, after the quarterly profit numbers of course, are the

- the number of new customers

- the percentage growth in customers compared to the previous quarter,

- the predictions for the next quarter and the total for the year.

Also for me is important if the company has free cash, as well as if they have loans and what, especially now in a situation of high interest rates. If I have time, I also listen to the press conference, because sometimes even from the tone of the executive or financial director you can get an idea of his attitudes and expectations .

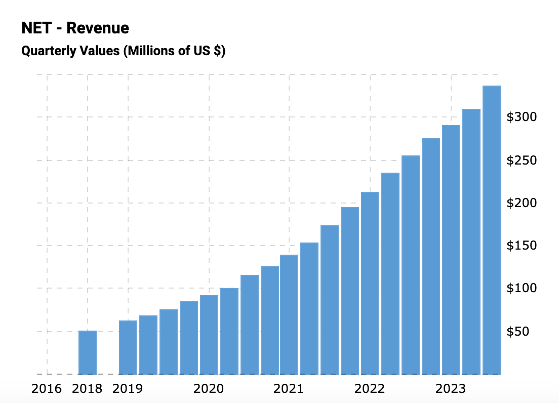

One of the sites I use to learn about current and historical financial performance is https://www.macrotrends.net , but information is available in many places.

For example, if I want to see Cloudflare ‘s financial information by quarter, I will look here – https://www.macrotrends.net/stocks/charts/NET/cloudflare/income-statement?freq=Q

an example of a component, important to me when I am selecting a company for my portfolio

Diverse Portfolio Examples

DataDog

Like Cloudflare , DataDog has been in my portfolio since 2020. Also a SaaS company selected on similar criteria. DataDog creates a software platform that allows its customers to monitor the efficiency and performance of their applications. It helps organizations gain better visibility into their IT systems, detect and fix problems, and optimize performance. I like the management team as well as the company is one from the leaders in their field . They have customers from all segments and have well-knit partner relations with the big cloud companies – Amazon, Microsoft and Google.

Tesla

Tesla company is very popular and doubt it needs a special introduction. But it definitely wasn’t like that in 2014 when I started investing in it. Although I follow the quarterly financial statements to date, this was not the leading criterion by which I chose it. The reason was mostly related to the feeling it gave me when I first saw the car more than 10 years ago and a colleague explained to me the concept of the electric car as software on wheels.

The feeling was similar to what I experienced when I held the first iPhone in my hand . For me it was a revolution . Electric cars, autonomous cars, electric grid charging, a CEO with a huge imagination working with incredible momentum, all the stuff of sci-fi books, which has always been my favorite genre. My investment in Tesla was my personal support for such a venture , because we must not forget that a real investor is not only looking to make money, but supports a certain business and its cause , becoming a co-owner in the company.

Eventually the company succeeded tremendously and the portfolio became very unbalanced due to the growth of this stock. I had to rebalance it in 2021, reducing the portion to the current percentages. Tesla has huge future potential in my opinion. When a company grows to such levels of being one of the 7 largest companies, it can expand its operations in any direction it wants. Just as Amazon is no longer just a bookstore, and Google is no longer just an Internet search engine, neither will Tesla be just a car company. And it’s actually taking steps in other directions.

The Case of Intel: Investing During Lows

And finally, I’ll talk about Intel, which has honestly been my most enjoyable investment this year, to show you another approach to picking companies. This spring, Intel hit its lowest levels since 2014. I’ve been following Intel for a long time because I happen to have many friends who work there and who have been complaining to me about the mismanagement of the company for years. Intel changed several CEOs, lost a lot of ground in the chip market, overtaken by AMD, threatened by Nvidia, squeezed by Qualcomm.

This had a direct impact on their share price , which has been on a downward spiral for 2 years now. But at the beginning of 2023, at a time when the most searched word on the Internet and the biggest hit was artificial intelligence, I decided to sit down and think about who is the hidden favorite, having already “missed ” the big AI hits.

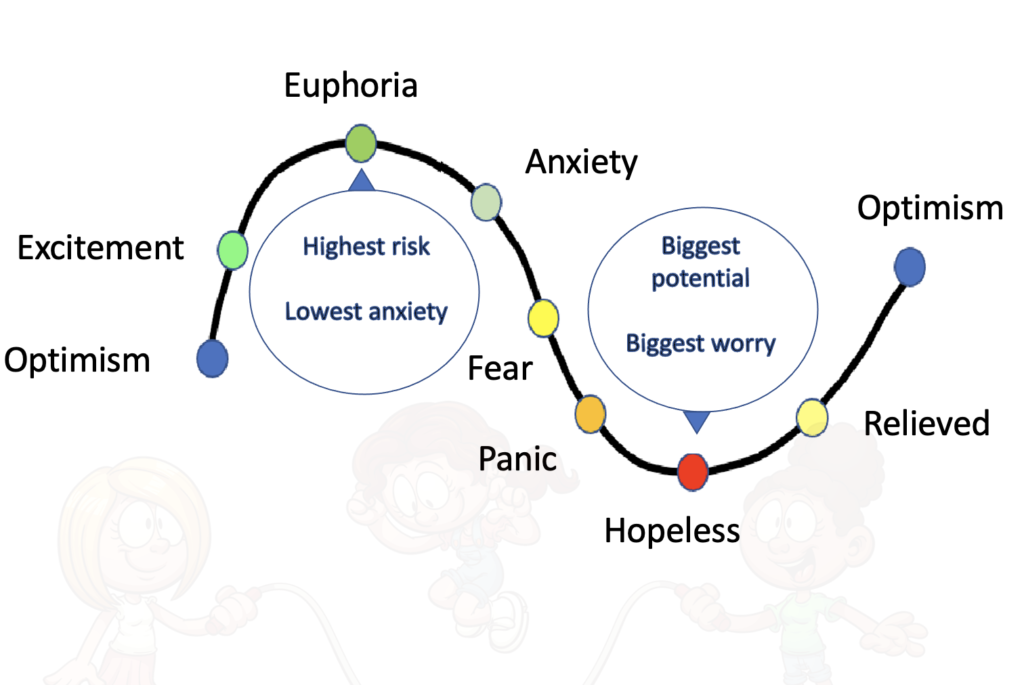

The biggest potential is when the price is at its low

Investment Philosophy: Spotting Unique Opportunities

If we look at the investor’s emotional curve, companies that are at low prices or bottoms from previous values are a safer investment and have more potential than those that are already are at high levels, as was already the case with Nvidia, Microsoft and others. I gave up on chasing trains that had already left and decided to go with this idea. At this point, my expectations are met. Intel has released 3 financial reports since my investment and the upside is there.

I’ve talked before about how important it is to have an individual mindset . Only if you find something that others don’t see, there is the potential to earn more. The best results come from the difference in expectations. Otherwise, the expectations are already factored into the price and the potential is lower. This doesn’t necessarily mean going against the grain and investing against it, but with enough discernment it is possible to spot such divergences that one can take advantage of. Even if it’s just a temporary gap. I have talked more about this in one of my favorite and I consider fundamental article for every investor – “Only a few of us”.

You see there is no one approach that I apply to all my investments. There are overlaps, but in some cases the numbers are most important, in others – the visionary vision and inspiration, in others – I make a short-term speculation, in the fourth – I take advantage of temporary hype. With 3-4 examples, I tried to introduce you to my way of thinking, without claiming that these examples are comprehensive enough.