SHARE

Many of you who follow my posts know that what I am most interested in and pay the most attention to in the materials I read and write is the psychology of investing. The way we think, consciously and unconsciously, manifests itself, of course, in the actions and transactions we make in the stock market. Whether we will be rushing in our decisions, or moderate, whether we will be led by hype, or will experience fear, greed, pride and self-confidence in trading is a function of our experience, knowledge and self-awareness. It is for this reason that I am strongly convinced that balance sheets are useful. Especially if you are the type of person who is always looking for an opportunity to improve yourself. This article is my assessment of the year 2023, which I am happy to share with you.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

Just as the taste of the meal you have cooked is a result of the ingredients you have selected and the way you have combined them, so the investment result at the end of the year is a product of the many different components you have mixed together. In this text, I will take the liberty of referencing and directing you to everything that brought me here. To my ingredients, knowledge and experience. My results are the result of all the energy I put into reading, thinking, writing and trying. They are yours to use of as you see fit.

I will divide this material into three parts. In the first part, I will share what is usually most interesting to readers, namely the numbers of the year. They are the fruit we have cared for during these 365 days, and we can, and even should, give ourselves the pleasure of finally plucking it on a late December day. If the year has been good, the fruit will delight us and bring us satisfaction.

In the second part, I will share with you the way, or more precisely the criteria, by which I select the stocks for my portfolio. Of course, I am not advising you to own these companies, but I am advising you to think about how you make your decisions, what sources you use, what articles you read and what shapes your opinions. This part I will put on a separate article, to keep this text more focused on the outcome.

I’ll end the text with some timid and careful glance into my expectations for the markets in the coming year. I will also share what changes I plan to make, completely independent of my expectations. As you will read there, I like to make this distinction – expectations from actions. While this may not seem entirely logical, we’ll talk more and you’ll see what I mean. But let’s get started.

Part 1 – The numbers

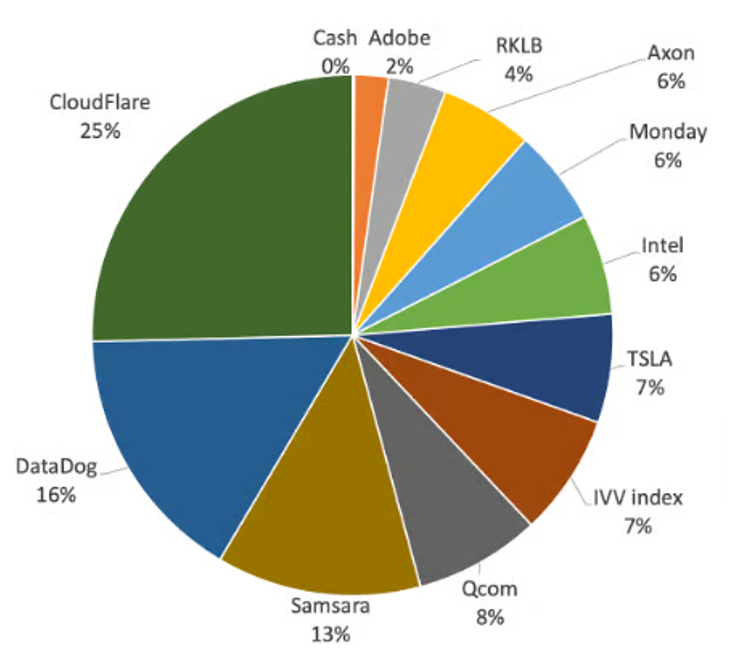

Concentrated portfolio

According to my investment strategy, I have chosen to build and maintain a concentrated portfolio (my portfolio). Or in other words, my pool of selected companies is relatively small. In the chart below, you can count only 10. I also hold shares in the IVV fund, which tracks the S&P500 index, in my portfolio. So you could say that actually the list of companies owned is much larger, but since the fund is only 7%, I suggest we ignore that fact for now.

The main reason I choose such a strategy is my desire to be able to closely monitor the companies I choose. If they are 20, 30 or 50, it will be simply impossible for me. I will not be able to make adequate decisions based on the news and financial statements of each of them. It’s one thing to follow 10 companies, quite another to follow 50. I’ve determined for myself that my limit is 15, and if they go any higher than that, it will be the equivalent of buying a fund tracking a broad index and completely eliminating the need for to follow anything . This is a trade-off between time, opportunity and expected return. And that brings me to the second thing to note about this portfolio.

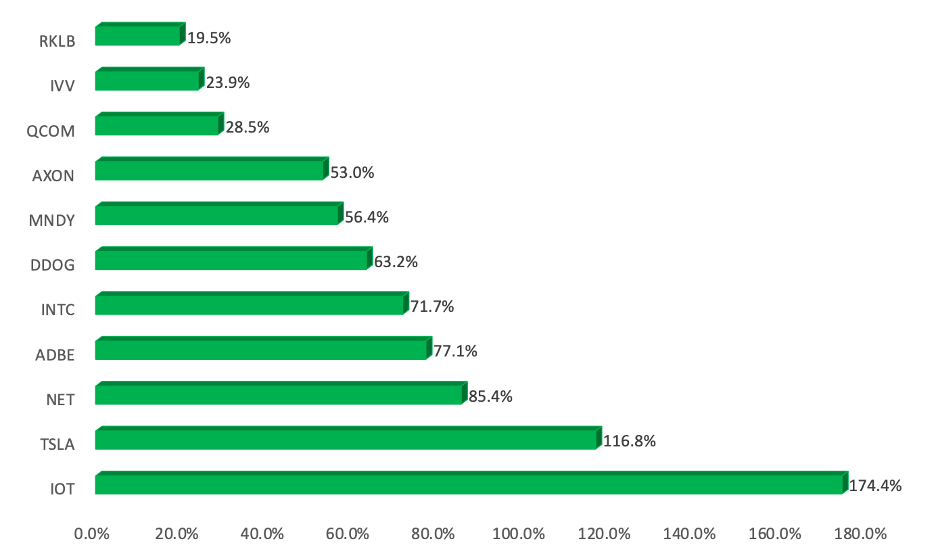

What stocks I have in my portfolio at the end of December 2023

High risk – potential for high reward

You probably noticed that the portfolio I chose is very high risk and very aggressive. We can agree that concentrated portfolio and aggressive portfolio are synonymous. Insufficient diversification leads to an increase in risk, and a highly concentrated portfolio is just that – poorly diversified. The only real diversification in my portfolio is holding IVV, but due to the small percentage, as we already said, we can ignore this fact.

Moreover, not only is the number of companies small, but they also represent only one sector of the market, namely the technology sector. Although it has boomed with tremendous force in the last 15 years, there is no guarantee that it will continue in the future. And last but not least, this portfolio is high-risk because most of the companies chosen to be part of it are not well-known and established world-famous companies, but are quite newbies that have been out in the public stock exchanges for a few years. That is, these are the so-called growth companies. And naturally comes the reasonable question of why I chose such a portfolio. The answer is simple – to search for high yield. Each of these companies has been carefully selected based on criteria that will be discussed in the next section.

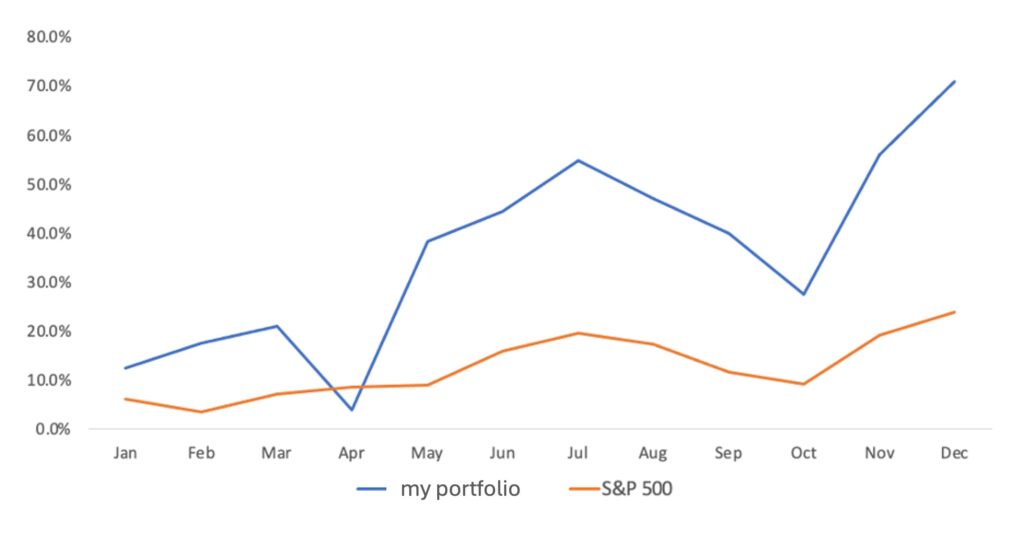

It is time, as we agreed, to start picking the fruits of this year. For the year 2023 (of course, 10 days to go, but it is unlikely that anything significant will happen) this high-risk portfolio achieves a 70% return (moving between 68% and 72% in the last week).

Comparing to S&P500

By comparison, the S&P500 is hovering around 21% (21% to 24%). Or my portfolio is nearly 3 times ahead of the index. But anyway, a great achievement for both my portfolio and the index. However, to be perfectly honest, in 2022 my concentrated portfolio was down -59% , while the S&P500 was only -20% behind . If you’re good at math, you’ll quickly realize that after a -59% drop , the subsequent +70% growth is nowhere near enough to get things back to where they were. My portfolio is still about -29% from where it ended 2021 and needs another strong year to erase the negatives of 2022.

comparison graph between my portfolio performance and S&P500

The risk that is taken with a concentrated and aggressive portfolio is prominent. The portfolio is extremely volatile, rates move up and down with frightening force, and it’s an adventure that’s not for every investor. I’ve spoken and written many times about the feelings you get when you watch your investment melt away day after day. ” It’s not nice at all ” are the softest words to describe these feelings. The article ” About the pain, the gray hair and the path forward“ talks about exactly this difficult situation and how one can deal with it.

Yet if I think about it and drill down into the numbers for the year by month, as well as the year before and the year before last, I see a multiplier of about 2x relative to the S&P500. When the index falls, my portfolio falls by more than 2 times. If the index goes up, my portfolio goes up at least double. This makes me optimistic because historically the years in which the index is profitable are far more than those in which it is not. So this reasoning leads me to think that in the tough years I should just bear the pressure, withstand the emotional strain and continue to maintain a quality selection of the right companies. These are, of course, very optimistic wishes, but backed up by numbers from my investment past. But let’s leave these considerations for now. They are not the most important thing.

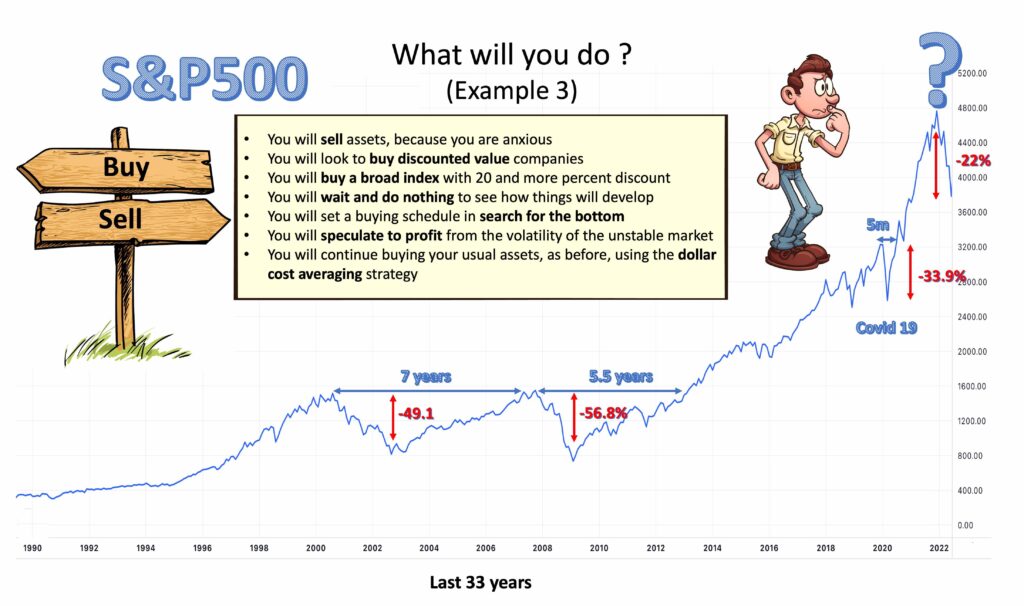

market falls in the last 30 years

Why the down years are not a waste of time

There is something important to note here. On initial look, it seems like 3 years will be wasted – 2022, which was a difficult year for all investors, the current year 2023, which is catching up to some extent , and possibly 2024, if it is kind enough to get us back on track. But the years have not been wasted at all. I will give you several arguments for this.

Soft landing

If we think carefully and look at the history of the last 30 years (see the graph), we will see that crisis periods rarely take place in only 3 years. In the year 2000, a market crisis started which lasted for 7 years before the index values bounced back, only to start another 5 years of crisis in 2008. In other words, if we “get away” by only 2-3 years and, as desired by the Federal Reserve, to have a soft landing , I think we should be happy.

The higher potential when buying low

The second argument that the years should not be seen as lost is the fact that if we follow the strategy of investing regularly and constantly putting aside our income for investments, the low years like 2022 are excellent opportunities to buy stocks at undervalued prices, on promotion.

It is this approach that helps to climb the ladder very quickly when the hard part is over. In 2022, I made great efforts, the more my stocks lose their value, the more diligently I invest in them. I call this strategy “searching for the bottom”. It was enough to judge that the problem was global, not particular to the companies in my portfolio, and that the global economic environment was temporarily weighing on them. If you hold shares of companies in which you are confident, these periods are not only not wasted, they are the moments that smart and resourceful investors look forward to.

Learning lessons during harsh times

And the last argument I have that there are no wasted years is, of course, the lessons learned under conditions of stress, terror and fear, watching my investments go in a direction I didn’t want. Steel is tempered in fire – so are our feelings and skills tempered by investing in a difficult environment. New ideas, new strategies and a new approach are born. A lot of creative ideas came to me, I made a lot of positive changes in the portfolio, trying to get out of this situation. Some of them I have shared in previous articles like Let’s make a bet, or stock options. I will tell you about others in the next part of this text.

My portfolio performance in detail

Another thing you’ll notice in my portfolio is that there are generally three groups of stocks:

1) Stocks I strongly believe in – these are Cloudflare, DataDog and Samsara. They represent over 50% of the entire portfolio.

2) Companies in which I have moderate confidence – 5 of them.

3) And those with which I am experimenting, so to speak – RocketLab and Adobe.

Profitability of “my companies” from the beginning of 2023

If we look at the percentage growth graph in 2023, we can conclude that Samsara alone has grown to the position of third in my portfolio, and Cloudflare and DataDog, my old investment choices, fully justify my confidence and pull the whole portfolio forward. But anyway, the good news is that of the selected 10 companies and the IVV fund, there are no red percentages, no loss-making companies .

The Big 7 performance in detail

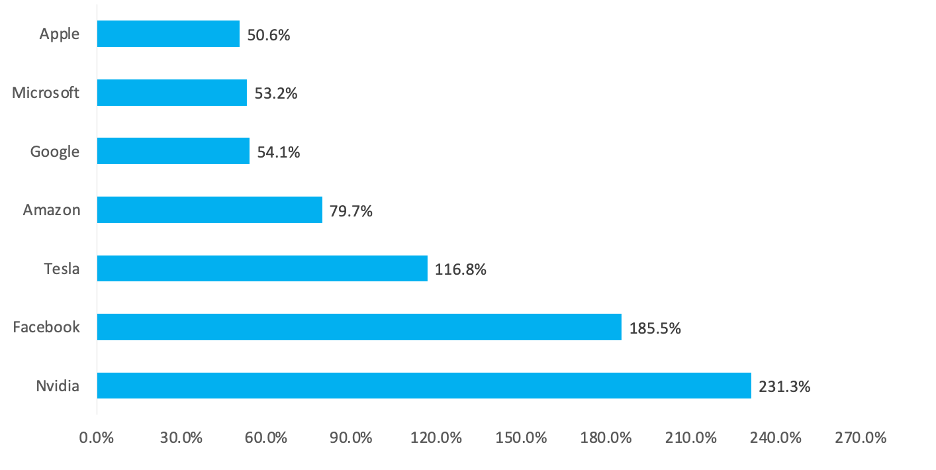

Let’s take a few minutes to talk about the ” Big 7 ” – see the chart below. With some friend investors, we discussed whether it would not have been more successful during last year’s decline to bet as a safer long-term investment on the so-called “value” companies – well-established names, leaders in their activity, temporarily undervalued.

Looking back over time and calculating the percentage growth for this year, I agree that it was an option, “YES”. Of course, it’s easy to say from the perspective of December 2023, but as of January 1, 2023, who could have predicted with such confidence that artificial intelligence, and in particular the Microsoft-sponsored chatbot ChatGPT, would create so much hype and anticipation and I’m going to shoot to the moon the shares of Nvidia, Microsoft, and anyone else who has claimed anything to do with AI. If you’re familiar with hindsight bias, which I’ve written about in the “Biases and traps”, you’ll know that it’s easy to be misled into thinking that you knew things would turn out this way . But in reality, at the time you had to make decisions, you had no way of knowing.

On the other hand, I cannot completely abandon a strategy that I have been following for years and suddenly switch from growth companies to value companies just because a difficult time has come for the economy as a whole. If I had done that, I would have had to leave all the information I had gathered about the companies in my portfolio, in which I did not see anything worrying about their future development, and start following companies that were new to me. I just didn’t see a good reason to sell the ones I already owned.

Profitability of the big 7 in 2023

Cherry picking is still key. Even in a strong year

Before I end this part, I want to address something that seems very important to me. 2023 was indeed a good year, but this does not mean that it was positive for the development of the entire market . Up to this point in the article I have presented you with a set of very carefully selected companies from my portfolio as well as the big 7. This deceptively creates the illusion that such percentages are ubiquitous in the market and that wherever one invests this year will achieve from 50 % up. Nothing of the kind.

This is a typical example of a fallacy caused by incomplete information or manipulatively presented information. I say this to draw your attention to the fact that it is your own responsibility to do your own research and gather complete information on which to base your conclusions. Otherwise, someone may intentionally or unintentionally lead you to wrong conclusions.

Here are some examples of stocks that didn’t turn out to be such winners this year. From the index of the big 30 – Dow Jones, Chevron is negative -12% , Johnson & Johnson -9% , Coca-Cola -4% , as well as several that do not lose positions, but are far from the phenomenal percentages we talked about above – Nike +3%, Cisco +4%, United Airlines +13%, IBM +14% . Another big company, like Dish Network, which I remember owning in its good times 7-8 years ago, is at a terrifying -66% for 2023. What is happening there… ?

And here are two examples of companies that at some stage during the year were part of my portfolio and at moments after bad financial reports I decided to sell. They also do not enjoy any good results and deserve to be at least temporarily forgotten by me – Enphase Energy -54% and Bill -23%.

I believe these examples convince you that even in an overall strong year like this 2023, picking a group of winning companies is by no means an easy and simple job. And it would be very proud if I forgot to mention that more often such success is also a result of being just lucky.

Part 2 – The selection

see article “My Criteria and Methods for Company Selection”

Part 3 – The future

I know that I know nothing

The last part of this text has come, in which I will talk a little about the future and my intentions. In his book “The Little Book of Behavioral Investing” (read the short review i did on it), James Montier tells that in an experiment, professional financial analysts predict worse than a group of inexperienced students which of two groups of stocks will performed better in the following year. In that sense, who am I to be able to give a true prediction about the future and to be able to see what will happen.

The market in 2022 surprised me well enough to make me realize that I know that I know nothing. Can I know if in the next year another pandemic will come, another war will break out, a meteorite will fall or another “Black Swan” will appear, as Nassim Taleb writes about in his book of the same title? How then should we invest if we cannot predict the future? I’ll tell you what I’m going to do as soon as I tell you my expectations anyway.

Interest rate cuts and emotional retail investors

For next year, I am careful optimist. Globally, the reduction in inflation and the halt in interest rate hikes by the Federal Reserve were well received. Even better received was the news/promise of a possible cut in those interest rates next year. This is precisely what accounts for the powerful upward acceleration of the indices in December.

Watching the markets in recent years, with the development of investment brokers and easier phone investing apps, I feel that more and more individual investors are getting involved in the markets. And it also seems to me that a lot of them are investing emotionally, meaning the news itself is swinging more and more people in one direction or the other depending on what news comes out, helping to drive more extremes and volatility in prices. But that’s something I can’t prove for sure, and for now I’m watching with the idea of taking advantage by buying into a potential bullish hype created by news related to AI, for example.

Personally, the 10 stocks in my portfolio are performing well. I like them at this point and future financials will determine whether they stay in my portfolio or not. In his book The Psychology of Money, Morgan Housel offers a slightly extreme way to check for yourself whether your portfolio is what you want it to be. His idea is once a year to sell our entire portfolio and buy it back. If you buy the same shares and in the same ratio, then you really want to own them. Of course, this approach is extreme because the sale will likely create a tax event for you to deal with, but I think you get what he means. I feel good and relatively comfortable with my chosen positions, however I plan to make some changes. I’ll end with just that.

Reducing risk, increasing conservatism

As I have already shared with you, whatever optimistic expectations I may have, I do not think there is a single person on earth who can predict what will happen. I want to separate myself from my expectations and not rely on them. The variables are too many to consider. In my investment life, and not only, I try to follow the rule of doing the best you can, and whatever happens . And in that sense, what will be the best that I am capable of?

The experience of the last few years, as well as the literature I have read, make me think more long-term, more moderate and more conservative. As I wrote in the article “Time, profit and contributions“, with a skillful balancing of these three levers of investment success, the goals can be achieved without such great aggressiveness and without the need for daily monitoring and emotional strain. What I want is to solve the equation by subtracting the “uncertain future ” variable from the formula. Assuming a 10% return per year is easily achievable investing in funds that track broad indexes like the S&P500, then I can solve the equation by moving much or some of my portfolio to a conservative fund while increasing monthly contributions.

Using Excel spreadsheets similar to the examples I’ve given in the article, I’ve simulated various scenarios where the goals are met without the mad rush of the last 10 years. My thoughts go in the direction of establishing a stable, conservative part that grows without the need for continuous management, putting up with a moderate percentage of return per year. At the same time, I will continue the struggle with the aggressive part of the portfolio, which will be only wishfully necessary to achieve ultimate success, but not critically necessary. Practically, this will mean increasing the IVV percentage in my portfolio.

Our good luck for 2024

I want to believe that the Wall Street Bull magnet that was given to me just a few days ago will bring good luck, so I’m sharing it with you. Without luck, nothing will work. I wish everyone a successful 2024!