SHARE

Introduction to Options Trading

Recently, I had a discussion with a friend about investments, and our conversation quickly shifted to options trading. While he was familiar with the concept of options, he had never actually engaged in them. I shared my experiences in this field, and a month or two later, he contacted me to say he had started making his first trades. This inspired me to share what I learned about options 15 years ago when I first developed an interest in them.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

The Three Main Functions of Money

I have mentioned this several times already, but let me remind you once again. There are three main functions of money:

To buy you things that make you feel better and fulfill your desires and dreams.

To make you feel safe.

To make even more money to perform the first two functions.

The Emergency Fund

I am an expert only in my own desires and dreams, so I can’t give you advice in that direction. I’m sure you know very well how to use money to give yourself pleasure. On the question of the function of money to create a sense of security, this is a topic we have already discussed. It is the topic of “the emergency fund.” Let’s quickly mention it again. The emergency fund serves as a backup for situations where you need to withdraw funds to handle unforeseen circumstances.

Usually, this emergency fund is money that you’ve decided not to use for making more money; you’ve set it aside in a safe place. Most often, you should deposit this money in a bank to be quickly and easily accessible. You can read more about the emergency fund in the article “Nik, tell me how to invest.” Now, let’s shift our focus to the third function of money.

Opportunities in Options Trading

Today’s topic should interest many of you who are eager to discover new ways to make your money work for you. I promise that we’ll cover the matter in a way that, by the end, you’ll see you don’t need to be an expert to apply what I’ll teach you. You don’t need to be a risk speculator or a day trader either. Instead, you might identify as a conservative, long-term investor. You may prefer individual stocks or have your money in a fund tracking a broad index. Either way, you’ll still be able to take advantage of the opportunity we’re discussing.

You must have heard after the fact about some kind of discount or bargain. “Yesterday there were tomatoes in Costco with a 50% discount “. But you didn’t buy because no one told you. Very often we miss out on taking advantage of something simply because we don’t know about it.

If you’re the type of person who likes to turn to the last page of the novel they’re reading, eager to see what happens next, skip to the end of part two of this article. The most valuable and interesting is there. But to understand and believe it, I recommend you go in order.

Of course, the classic way to profit from trading stocks is to buy low and sell high after the price rises. However, many stock traders also have a bit of a gambling streak. We can be greedy, always looking for more ways to make extra money. Just as sports fans often enhance their enjoyment by betting on the outcome of a game, investors seek similar thrills in the market. Let’s explore how we can achieve this with options trading.

Trading options generally means placing bets. When two people place a bet against each other, it usually means that the first person claims that something specific will happen. The other person opposes this and claims it won’t happen. And depending on who is right, there are different consequences.

the nice guys

In life, you can make a bet about anything. I started with the sports analogy, let me continue with it. If you go to a bookie, you can bet that a team will win. This is the most popular bet, but not the only one. Bookmakers make it possible to make endless other bets around the same game. For example, in soccer, you can bet on which player will score the first goal. You can also bet on who will receive the first yellow card or who will take the first corner kick. People’s imaginations seem to be endless and you can probably bet on which player will have his shoe untied first.

Understanding Covered Call Options

In the world of investing, placing bets is no exception. There are many types of options. Some of them are more difficult to understand and implement, while others, on the contrary, are easy and intuitive. Today, we’re going to introduce a relatively easy investment bet. As you’ll see, it fits perfectly into your style and doesn’t deviate much from what you’re already used to when investing in the stock market. We will consider the execution of the so-called investment operation “selling a covered call option“. And now, since the name of this option is kind of confusing and not very intuitive at first, I will move on and dive right in.

The Mechanics of Selling Covered Calls

To sell a covered call option in simple words means:

I will bet that the price of ABC shares you already own will not rise above price X before or on a specified future date (say the following Friday).

- The price X has a term and is called strike price.

- The specified future date is called expiration date.

Here is an example of a bet that I could offer to some of my friends:

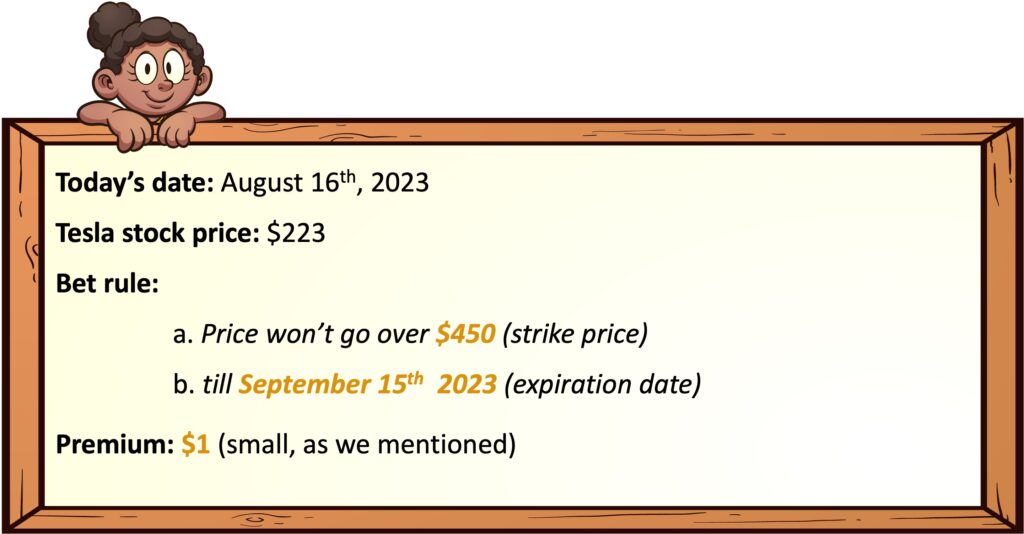

“Guys, I say that by this time next month – September 15, 2023 , the share price of Tesla will not surpass $450 . Who wants to bet?”

At the time of writing this article, the stock price of the company Tesla is around $223. And I honestly highly doubt, it will exceed $450 in a month. This would basically mean that Tesla will double in 30 days. Highly unlikely. And yet somewhere out there, there is someone who is ready to accept such a bet.

Risk and Reward in Options Betting

Now let’s go into a little more detail and pay attention to the condition of this bet. There are some details you need to be aware of. Read the following 4 points.

- In order to offer such a particular bet (covered call option), there is one essential condition. You must own at least 100 shares of the company for which you want to sell a covered call option . That’s why it’s called covered because you cover the bet with your shares. That is, you must already be their owner. There are also uncovered options, but we will not talk about that today. Whether you’ve owned those 100 shares for 10 years or 5 minutes doesn’t matter. I say this because part of your strategy in selling a covered call option may involve first buying 100 shares in order to fulfill the condition of this bet. The minimum is 100, because selling one (1) call option contracts this bet for 100 shares . You can sell 10 covered call options, that is, making 10 bets, but in that case you must have 10 times 100 shares or 1000 shares of that company. Nothing complicated so far. That’s just how this bet was invented, and it’s a necessary condition for it to begin.

- The moment I sell such a covered call option, I receive money – a premium . Regardless of the outcome of the bet, whether I guessed right or not, I get this premium the same moment the deal is closed. The premium amount is known in advance. Which helps you decide whether it is worth it or not to make such a bet. If you make the bet, that money is instantly yours to do whatever you want with it. You can buy something with them, invest them or keep them. This is your profit . This is the money you might be bringing in as extra income. The tomatoes on sale from Costco that no one told you about.

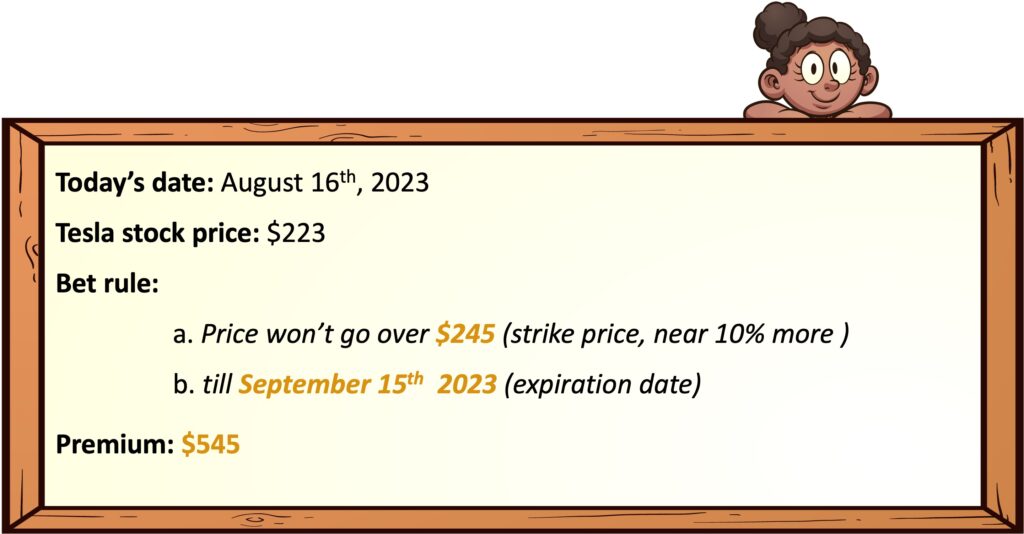

- I mentioned that the value of the premium is known in advance, but the exact amount depends on how likely the event is to occur. If you bet that Tesla’s stock price won’t exceed $450 in the next month, the premium you receive will be small. However, if you bet it won’t rise above $245—a 10% increase from the current price—the premium will be much higher. This scenario is more likely than a doubling of the stock price. The risk of losing the bet is higher, so you deserve a greater reward for taking such a risk. There is logic in this, of course. For instance, if you bet that a third-division soccer team will beat top-ranked teams like FC Barcelona by 3-0, the reward will be substantial if it happens. This reflects the usual trade-off I discuss in many of my articles: higher risks lead to opportunity for better rewards. This shouldn’t be surprising.

- I mentioned risk, so it’s time to talk about what you stand to lose. One condition of this bet is that from the time you place the bet until the expiration date, if the stock price exceeds the strike price, the other party can choose to buy your shares at that strike price. They are not obligated to do so; the decision is theirs. That is, if you lose the bet, the other party has the right to buy your shares. You won’t lose them just like that for no money. You don’t directly bet money either. What you stand to lose is potential future profits from a further price increase beyond the strike price.

Practical Examples of Options Strategies

Let me explain this along with examples to make it crystal clear. We have made the following bet:

Example 1

Example 1

From the moment this bet is placed, one of two things can happen. Within the next month, the price may or may not exceed $450. And this is what happens depending on which came true:

- If it does NOT exceed $450 , the situation is clear. You get the premium (in this particular case it’s $1) and that’s all that’s going to happen. And remember, this dollar was given to you at the very beginning of this deal. At the end of that period, you still own 100 Tesla shares + $1 (if not spent already on ice cream)

- If the price exceeds $450 at any time during that month, the person you bet against can choose to buy your shares at the strike price of $450, but they are not obligated to do so. You might wake up one morning during that period and find that you no longer have 100 shares. Instead, you have $45,001 because your 100 shares sold at $450 each plus $1. And that’s it.

Let’s reflect a little on the pros and cons of making such a bet.

The pros

- The first positive thing is that you get a premium . To use the Costco tomato analogy, someone gave you a tomato. True – only one, but yours. You get it either way, regardless of the turn of events.

- The second positive thing especially for the second case when the price reaches or exceeds $450 is that it became such a miracle that you doubled your investment within a month. It has gone from $223 a share to $450 or more.

The cons

- The first negative thing in both cases is that there is only one tomato. Just like it doesn’t make much sense to drive to Costco just for a free tomato. The cost of gas or energy to get there will likely exceed the value of the tomato. Similarly, your broker may charge a fee for placing such bets. If the fee is higher than the value you gain, this transaction becomes pointless from the start.

- And now let’s pay attention to the second negative thing. Please be careful here because this is the “bad” thing that can happen to you. You will decide how bad it is. Any further increase in the price above $450, (in the second case) will be, so to speak, a missed opportunity for you. Instead of owning the stock, which will eventually be worth $470, $500, or $520, you will have sold it for $450. This situation might only be bad in theory. For instance, imagine if on September 15, Tesla stock hits $500. You would regret selling 100 shares at a $50 difference, resulting in $5,000 in lost opportunity profits. However, by Monday, September 18, or a week later, the price could fall back to $440. Then, you could buy back your 100 shares for $10 less than you sold them, if that’s something you really want.

People often find the feeling of missed profits painful. In the case of selling a covered call option, the “danger” is that you stay at the station and the train leaves, so to speak. You sold your stocks at the strike price, and the price never dropped below it again. You might get regrets, but in the end, you should quickly soothe your feelings. After all, you have made money by this sudden unexpected increase. And it is unlikely that this increase in price will be forever and it will never come back. - The last negative thing that could possibly worry you is if the share price actually starts to go down . That is, at the end of the period the share is worth less than at the beginning. If you’ve held those 100 shares for a long time and plan to keep them, the fluctuations wouldn’t really matter to you. You’d benefit from selling a covered call option because you’re earning some premium. However, this inconvenience becomes relevant if you did not already own 100 shares, but you bought them to execute this bet. We will return to this towards the end of this article. Let’s move on with one more example.

Example 2

Example 2

This example is similar to the previous one. The company is the same, the expiration date is the same, the starting price is the same. The difference is in the much larger premium and the lower strike price of $245 on which we bet won’t go over by the expiration date. For a stock like Tesla, a 10% increase in a month is not much. This stock jumps or falls with just a wink from its CEO. That is, the risk of going above the strike price is greater than in the previous example. But you get a significantly higher premium for that too. $545 equals 2 shares of that same company if you choose to spend it for that. As we said, you receive the premium at the moment of making the bet and you can use it at the very same moment for whatever you want.

As in the previous example, if the price does not exceed $245 by September 15th, you keep the stocks + the premium. If it goes over, you wake up one day of that period (usually the Monday after the expiration date) with 100 times $245 = $24,500 + $545 and are free to do with them as you see fit. You can buy something, invest in other stocks, or if you decide and the price suits you, you can buy Tesla shares again if you see them at a price lower than what they sold for as a result of the options bet.

Advanced Insights on Options Trading

With that, we could end this material here and let your imagination and personal motivation begin to visualize and seek the opportunities that selling covered call options gives you. But in my opinion, the most interesting is yet to come. Let me help you out a little more by pointing out some additional things as well as throwing in some interesting ideas. Let’s move on to part 2.