SHARE

I felt compelled to write this article for several reasons. First, to address questions I’ve been asked; second, to sort through emotions I’ve been grappling with recently. Writing helps me make sense of my thoughts. It quiets the noise in my head, laying everything out clearly. Let me first start with the facts.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

For about 5-6 years, I’ve had a SuperMicro computer tucked away in a closet. It’s been working quietly, efficiently. Occasionally, its powerful fans get loud, a reminder they need cleaning. But overall, this well-crafted machine has served me well without much fuss.

Since i took it out to show it to you, I will use the opportunity to clean the fans

People who follow my portfolio may recall that I didn’t keep my SuperMicro shares for very long — just about a month and a half. From mid-May to the end of June 2023, my investment appreciated by 41%. This increase followed a 30% rise after the company’s financial report in early May. I base investment decisions on fundamentals, not on technical analysis, rumors, or social media trends. I see stock price changes as reflections of financial performance and future prospects, as outlined by the company’s management. SuperMicro’s performance since early May convinced me of its potential. This led me to invest with the intention of a long-term hold.

However, the rapid surge in value, without any new developments or fundamental changes, prompted me to reconsider. Increases in price that aren’t supported by solid fundamentals are often just as likely to reverse irrationally. Therefore, I decided to take my profits and exit the investment.

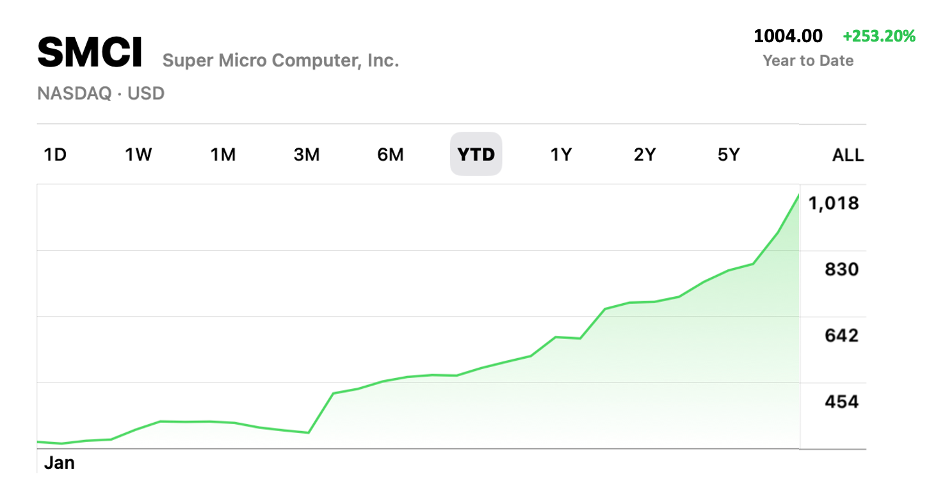

The proceeds from this transaction were then moved to Intel, which, to my satisfaction, grew another 40% by year’s end. Meanwhile, SuperMicro’s stock price lingered around the level where I had sold it, affirming my decision. This story would have ended there, not warranting an article, if not for SuperMicro. But not the one from my closet—its counterpart in the stock market caught my attention again. After more than half a year of stagnation, the stock barely changed during the financial reports in August and November. Then, like a bear waking from hibernation, the stock price sprang to life. It captured everyone’s attention with a staggering 250% increase in just the first month and a half of this year. This unexpected turn of events stirred emotions and thoughts, not just for me but for many observers.

SMCI stock chart year to date

“Hello ! What is your opinion about Super Micro Computer (SMCI)? Is it too late to invest?” ,

writes a guy on an investor’s forum on Facebook. Answers in the comments below range from “YES, it’s a great company” to “NO, it’s too late.” They, of course, pass through all shades of personal conviction. But as we all realize, hopefully to some degree at least, no one has a crystal ball to know. As I often like to joke, the odds are 50/50. Either it’s late or it’s not late. Either the roulette’s pill falls on black or red (sometimes on green). But that is not what is important here, and hardly anyone will see me to answer such a question. Because I know, I can neither claim nor to take the responsibility to advise anyone else. However, other things are important.

The madness of forecasting.

I begin with a reference, for the umpteenth time, to ” The Little book of Behavioral investing ” from James Montier and particularly to the chapter “The Folly of Forecasting”. The text of this chapter begins with a quote from the philosopher Lao Tzu.

“Those who know do not predict, and those who predict do not know “

Montier reveals a discouraging number of facts from social experiments showing that even professional stock analysts struggle with expectations. If you are a financial analyst, I apologize if this offends you. According to these experiments, analysts are wrong 45% of the time when predicting a company’s performance for a year ahead. It’s essentially a game of roulette—black or red. The company will either do well or it won’t. Considering this, how can we, the forum specialists, confidently answer whether it’s too late to invest in SuperMicro? And yet, we do. But don’t listen to us!

Benjamin Graham, Warren Buffett’s mentor, says that forecasting does not fall under the job of security analysis. However, financial analysts are constantly doing it. Perhaps because it gives them attention… But let’s leave them for now. What is important to know is that forecasting is an inexact “science” and relying on it for investment is disastrous. In the article, “Luck, Skill or Something Else,” I explain in detail why I believe an investor’s actions should not always directly relate to his expectations.

The principle of herd mentality

I will take the liberty of quoting another short paragraph from a different article – “Only a Few of Us”:

“When people in investment forums ask whether to buy or sell a stock, they show a reliance they might not recognize. To profit in investing, you must spot what others miss. The difference in perspective between you and the market can lead to significant opportunities.”

In other words, if many people share the same opinion about a company’s value, that outlook is already reflected in the share price. If we think SuperMicro is great and anticipate a bright future, we likely bought its stock and drove up the price.

To avoid repetition, I recommend reading “Only a Few of Us” or “Of course I can beat the market.” These articles explain why following the herd isn’t the most profitable strategy.

When asked this question, I’ve joked about surveying for answers and doing the opposite. Investors often remark that when even taxi drivers talk about an asset, it might be too late to invest. The asset is likely overpriced.

Taking responsibility

In the same way that a person asks the opinion of others to decide whether to buy an asset, he will subsequently need to see others again to ask them whether it is time to sell that same asset. Will you always be asking what to do? And how long will this continue?

It is easy for us to see that if you need others to determine your actions, then you have not yet developed enough personal rules, criteria and discipline to justify the decisions yourself. You probably lack experience to fall back on. Which, of course, there is nothing wrong with. We cannot blame anyone for it; on the contrary, we want to protect them. By relying on someone else’s help, they may fall into a trap, leading to feelings of gratitude or anger towards others.

Regardless of whether you get a “YES – buy this asset” answer or “NO – don’t buy it,” your personal benefit will be significantly smaller. This is especially true compared to when you take responsibility for your own decision, regardless of the outcome being positive or negative. In that sense, it doesn’t really benefit anyone by giving prediction advises. Instead, there is a saying that it is more important to teach a man to fish than to give him one.

Following personal principles and rules.

When a friend asked what I would do now, knowing I gave up on those shares long before their rise, I said I wouldn’t buy them. For me, it’s about principles, not because I regret the “what may now seem as the wrong decision”, from months ago, but for more significant reasons.

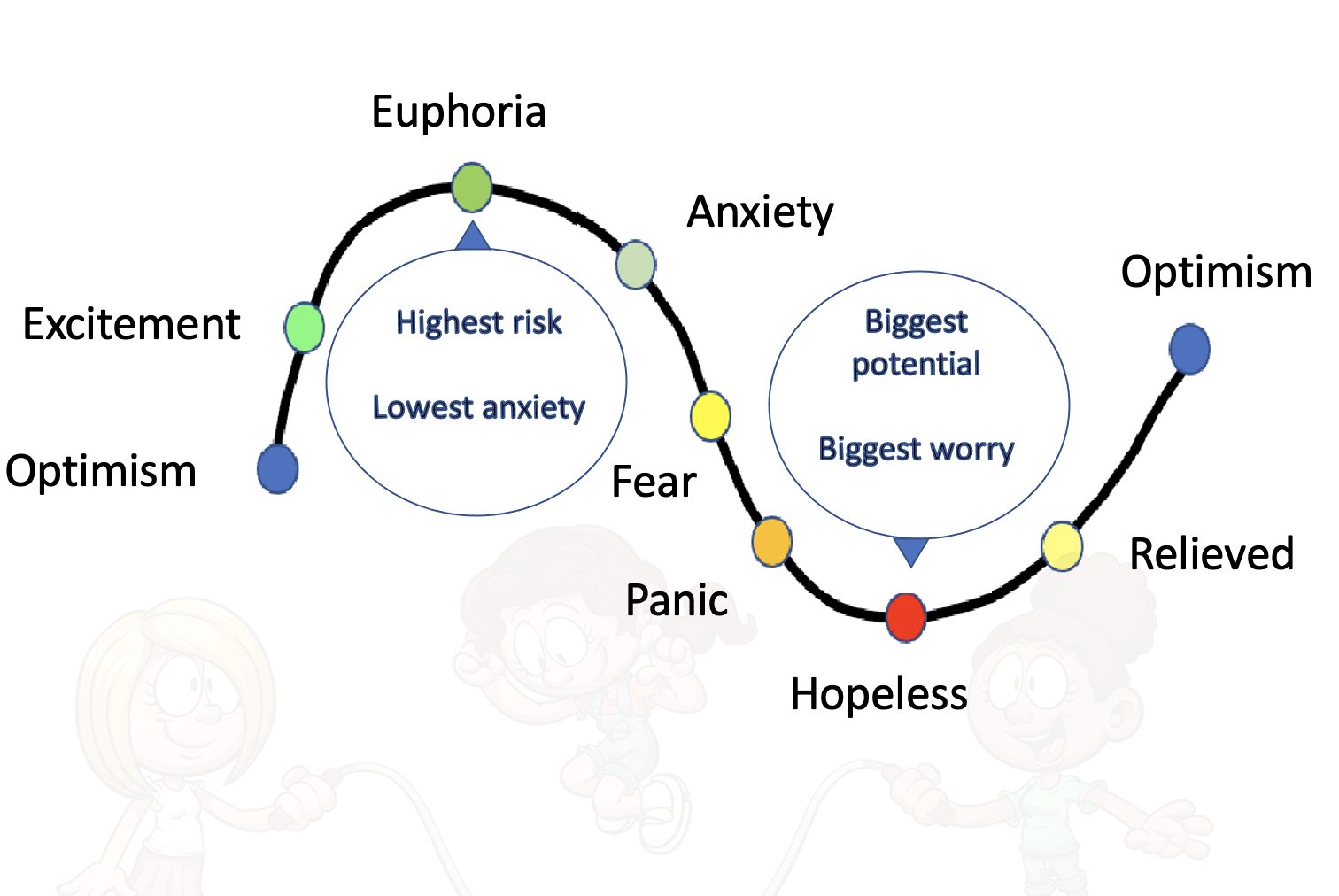

The emotional cycle of investing, shown in the picture below, indicates higher risks when prices are high and enthusiasm becomes euphoria. This principle involves managing the euphoria and stress from missed gains, and avoiding high-priced asset purchases. This isn’t just about SuperMicro but applies in general. Whether the price is $700, $800, or $1,000 after significant increases, it’s already in euphoric territory, having reached these values within a month or two.

the emotional curve of the investor

Allowing myself to chase this runaway train and possibly board its last car, my attitude is already strained. With every small correction, I will see the end of the rise and this will create emotions that will cause me to make wrong decisions. The very question “should I buy?”/”isn’t it too late?” lights the fuse of the emotional bomb, which at some point will unfaithfully explode. Does it make sense for me to dive in such an adventure? In the particular case with SuperMicro or with any train that left? Whether it left on the basis of magnificent financial results or as a result of euphoric hype. No, it’s not worth it, and that’s the principle. It makes a lot more sense to look for other opportunities, and new ones come out more often than you may think.

The pain of missed gains

The feelings

In this last part of the article, I will talk a bit more about the emotions. Of course, it is not pleasant for anyone to sell an asset that subsequently rises several times. The pain of lost profits is strong and sharp and hits the investor hard. On the one hand, it makes him feel stupid, on the other – regret that he had a good opportunity that he did not develop and benefit from. These emotions come to me quite naturally. But the difference between me and a novice investor is how I can transform that particular disappointment.

The coping mechanism

Over the years, I have developed techniques that cultivate my emotions, which I’m eager to share with you. I am well aware that the feeling of pain when investing is an inevitable part of the game. The stress accompanies investors not only when they miss a good opportunity but also during extreme and sudden rises in asset value. Even the investor who owns the asset feels the sting. Such a rise can lead to regret for not investing more, a typical case of hindsight bias. Additionally, any change or correction in the steeply rising curve can instill fear that the rise will end, threatening to take away what fate seemed to have gifted.

Extreme situations are a catalyst for strong emotions; great joy is often shadowed by great pain. In the untrained investor’s nature, conflicting and confusing feelings frequently emerge, prompting unmeasured, spontaneous, and incorrect actions. In my slightly humorous yet sad video, “The Tragedy of the Inexperienced Speculator,” I narrate the story of two fictional characters. These characters become emotional victims to the rapid rise in the price of an asset, which leads them to make extreme decisions driven by emotion.

Again, I’m talking about principles that need to be built and upheld. For discipline and for preparing a plan when entering an investment. For moderation and understanding that one will not get rich from a single hit on the stock market, but with long-term work and moderate, balanced actions. Because the lucky hit is often mistaken for personal skill and foresight. The element of luck is ignored and a precedent is set that is accepted as normal and similar high-risk attempts to repeat themselves follow, which rarely work.

the conclusion

I will end with words that I share with others, but also often with my own self. Nothing is final . What seems final to you today changes tomorrow. Joy turns into pain, and pain into joy. It doesn’t matter so much where an asset’s price will be in a month, two or a year, but where we will be in achieving the goals we have set for the long term. The two do not always coincide. Therefore, it is more important to understand not whether to buy or not to buy at this price, but how to invest in general.