SHARE

Part 2. How to deal with these feelings and what is the way forward?

Breaking free from the black octopus tentacles of suffering takes time and experience. But I will try to help you get ahead of the curve. This is not an easy task, because I am aware that there is no imposed wisdom and everything has to go according to the established order. That is, you have to experience it personally so that it becomes a part of you . These tips offer a benefit: when you encounter a difficult moment, you may remember or revisit these thoughts of mine. This can provide support and reassurance that your feelings are normal and that you are not alone in experiencing them.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

I will organize my tips into three categories.

The Illusion of Control

We often fall into the delusion that what has happened is a direct result of our actions. If we win, we think it’s because we were smart and resourceful enough. If we lose, it is because we made a mistake somewhere. In reality, however, things are not always exactly this way. Luck and the chaos of the world play no small role in our success or failure. As small individual investors of modest abilities, we are too often hostage to random events. It is wrong to assign to ourselves superpowers corresponding to those of fortune tellers and astrologers. We have a tendency to think that events are predictable, when in practice this is not true at all .

Let each of you answer the following questions from the position of an amateur investor in the stock markets:

- Could I have predicted the inflation of the last few years and the reaction to increase the interest rates?

- Could I have predicted the COVID epidemic?

- Could I have predicted the sharp drop in oil prices in the spring of 2020?

- Could I have predicted the bankruptcy of Lehman Brothers in 2008, which contributed to the financial crisis of 2008-2010?

- Could I have predicted the AI craze in 2023. Or the rapid development of the Tesla company in the past few years. Or maybe the surge in the stock price of graphics chip maker NVIDA ?

You could probably say YES to one or at most two of these randomly selected events, but you could hardly say YES to all of them. And each of them has or has had the potential to seriously affect your investments.

One of my favorite authors – Nasim Taleb – deals very well with this topic. In his most popular book – ” The Black Swan “, he says that in the process of investing there is always the possibility of random circumstances that cannot be predicted.

How often do you think you will be able to predict events correctly? And more importantly, how angry and self-blaming will you get if you fail to do so? Is it even in your power to try to pretend to be Nostradamus all the time and see the future? There are several studies and well-known behavioral patterns that relate to this delusion. The “Illusion of Control ” as well as the “Hindsight Tendency “. After events have already happened, “hindsight bias” makes the brain think they were predictable. For example, if your favorite team loses a game, you might tell yourself that you actually knew it was going to happen, even though you didn’t really think that way before the game.

As of today, I think it’s been pretty clear that Nvidia is going to increase its stock price so much in 2023. I’ve even mentioned this prediction to a lot of my friends who invest. In reality, however, my brain plays tricks and forgets that I actually had a lot of doubts about this. Which is also the reason why I didn’t buy it. And if I don’t realize this and don’t know about the retrospective tendency, I can only be angry and regretful.

Yes, here’s how you can split it into two sentences:

If you realize that accurately predicting everything is a chimera and not really possible, that knowledge can alleviate some pressure. It reduces the need to suffer when things don’t go as expected.

Practical Tips for Reducing Investment Stress

Letting go

When you decide to sell an asset, stop following its price afterward. Remove it from the list of assets you are tracking. Forget about it and focus ahead. At this point, it was your decision to let it go, so don’t let the future price movement sway you. If you don’t know what happened to the price the next day, the day after, or 2 months from now, you won’t be bothered by it. Stand behind your decisions, whatever they are. That’s what you decided, that’s what you did. You close the door and move on without turning back. Of course, you may buy the same asset again in the future. But let it be the result of new analysis and a judgment that it is good on its own, not because of regrets caused by the fact that after you sold it, its price went up.

Minimize Changes

Unless you are a day trader, don’t make changes too often . As we have already said, the Gods of joy are less than the Gods of pain and suffering. Every time you make a deal, you are as if turning to the heavens and calling upon them. Due to the mentioned inequality, those who will hurt you will visit you proportionally more times. And when you start making changes to fix one mistake, you’re more likely to make a second one. Thus spiraling into a series of mistakes that can eventually cloud your clear vision at some point. Swallow the mistakes, accept possible losses and focus forward, but not with the idea of correcting the mistake, but as if you never made it. The advice here is for regulated changes according to a plan. Allowing one to calmly count to 10 before taking an action.

Alternative Realities

Do not focus on alternative realities. Don’t try to calculate what might have been if you had or hadn’t made a transaction after the fact. This alternate reality serves no purpose other than to make you experience feelings. If you did better than the alternative scenario – fill you with excessive self-satisfaction, and if you find that you could have done better – make you sad. We often tend to see the alternative life as better, but this is not the case for two reasons:

- The first is that we are again victims of another well-known behavioral pattern – “the neighbor’s grass is greener than ours” . Our imagination tricks us into believing that what we don’t have is better, but it is usually misguided, mostly because of a lack of complete information about the alternative scenario.

- And the second is that alternative realities at this stage only exist in movies. Devoting energy to thinking about hypotheses from the past like “if only I had..” are a waste of time and energy, and will cause you mostly suffering. In theory, it seems that each of us could have made better decisions. But in practice, we really don’t know where those decisions would lead our lives and whether they would actually be good for us. Whenever I think about this question, I deliberately imagine a rather extreme example. I imagine a person who makes the appropriate decisions that bring him a large profit, with which he buys a small plane, which he subsequently crashes and dies. Without being extreme or fatalistic, the appeal here is more for moderation and abstraction from what might have been.

as of now the alternative realities are only in movies

If you’re going to do alternative reality calculations, do it for a positive purpose, not to cause yourself suffering. For example, I would recommend that you do an exercise for the difficult year 2022. See what your financial situation would have been, if you had followed the previous advice not to change things too often?

Reducing Stress from Market Fluctuations

Limit how often you check how far your investments have gone. Looking at market prices every day is tiring and stressful. The same goes for news, forums, etc. This constant monitoring leads to unnecessary suffering. Whether everything is falling today and we see a total failure in the distance, or everything is green and we are deluded, rubbing our hands contentedly, we set ourselves up for future disappointment and suffering.

We always raise our hands to the same sky with the same gods, and they respond in the same proportion. It has been long since I stopped letting the market dictate my mood for the day. I learned this the hard way and want to spare you that experience. I used to tell myself that nothing is final, and if the market is down today, it can change tomorrow, and vice versa. We often delude ourselves into thinking events are final, which leads us to believe that situations are irreversible. I’m learning to adopt a longer-term and more strategic view to avoid tripping over daily bumps in the road.

Work towards building the right attitude and cultivating your positive qualities.

Philosophical Insights on Investment Suffering

I told you at the beginning that to deal with the problem of suffering in investing, we could turn to slightly more unconventional and unexpected wells for wisdom. While philosophy may at first seem far away from the topic of investing, I would like to point your attention in that direction. Suffering is a familiar theme. No matter the cause—be it unrequited love, unfulfilled dreams, conflicts with people, or tough times in investing—the reasons for it boil down to the same thing. In Buddhism, it is said that this happens because of excessive desires, attachments and unfulfilled expectations. Accordingly, the prescription for dealing with suffering should not be through any other mechanism, but through an attempt to eliminate these sensations.

Redefining Values and Attitudes

But of course, just as you can’t tell someone who’s angry, ” don’t worry , it’s okay ,” and expect him or her to calm down, it won’t do much good if I tell you – don’t get too wishy-washy , stop getting attached to a lavish life or stop getting frustrated that you didn’t make 80% profit this year. But there is a workaround to accomplish the same thing, and I want to draw your attention to it. Namely, to work on your value system and mentality . If you give yourself a slightly different approach and attitude to investing, you will be able to shake off unnecessary suffering.

Self-Reflection and Risk Assessment

Let’s try to answer a few questions:

– Why do I want to earn money, what do I really need it for?

– Do I need them soon and why?

– Why do I want to be privileged and have more than others?

The idea of this question quiz is to stop you for a moment from the crazy race and do a kind of check on yourself. Maybe you did ask them before you got into investing, but there’s a good chance you jump into it simply because everyone else was doing it.

The difference between risky and moderately conservative investing, as we know, is the degree of risk. Do you really need so much money to take high risks that result in large financial and mental stress? Do you really need money quickly, urgently, within a few years, to engage in trades and investments that will only potentially bring high income but surely stress? Are you in a rush to achieve financial freedom and retire because your job is overwhelming, you don’t like it, and you don’t want to do it? Are you emotionally missing other thrills and joys in life and therefore need the adrenaline rush of frantic trading in the investment markets? See the article Financial freedom as a journey not destination.

If you’ve gone through a crisis of mental anguish because of a difficult investment period, stop for a while to rest and try again to rethink who you are and what drives the lofty goals you have set for yourself. Are there really any extraordinary circumstances that pressure you to choose risky instead of conservative and long-term investing?

Growing Positivity and Patience in Investing

I want to end this article with a few final words. Everything in our life, including our investment activity, is a chance and an opportunity to build and improve ourselves as individuals. In times of difficulty, can you try to change your perspective and get creative in your ability to see the good and the positive in everything? Can you turn for help to the gratitude, nobility, and optimism that I’m sure reside within you, but in the fast-paced race of investing you’ve probably suppressed? Can you show a little more patience , both with the markets and with yourself?

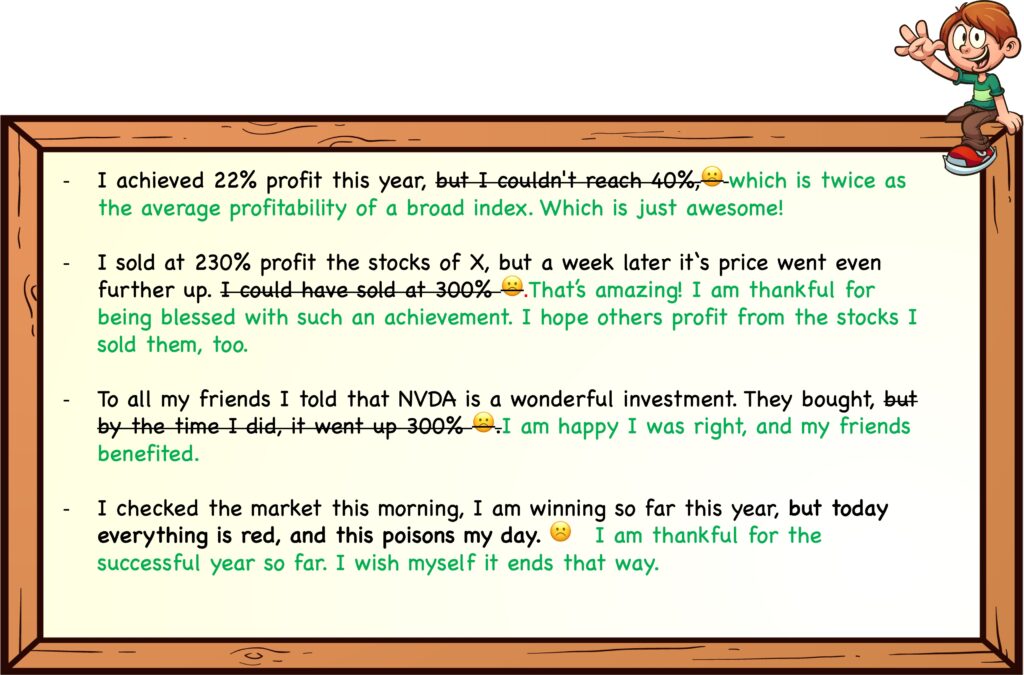

Let’s try to look and change the situations in which we suffered before, into ones that bring us joy and satisfaction:

With this, I intend to end this article and wish you to invest with pleasure and positive emotions. Good luck!