SHARE

A Sudden Stop and Reflection

I slam on the brakes and exit the freeway. I pull into the rest area and quietly park away from the other cars. Here I stop, wipe the sweat from my face and lean back in the seat with my eyes closed. “What happened? ”, “What did I do wrong ?”, “Good thing I survived ” are just some of the questions that run through my head as the engine cools down and the silence gradually begins to calm the frantic pulse and nerves. “What should I do now?‘ is the question that has not yet been born, but it will come.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

The Metaphor of Investment Crashes

The drama in the text of this paragraph may correspond to a situation in which you narrowly escaped a stalking serial killer or missed a car accident with horrific consequences. But the strength of the feelings you would experience in these situations could quite accurately describe your eventual investment crash in 2022 or any other year. A year in which, as if after a mad rush, stress and nerves, everything financially negative that could happen happened to you. Every prediction, every bet, every expectation, every attempt to catch up, beat or outsmart the market has failed and you have been thrown out like a dirty kitten licking its wounds in some thorn bush.

This text is about the pain of loss, the takeaway, the lessons and the way forward in the world of investing. It’s for those of us who have already experienced the feelings of failure, and for those who haven’t yet… because they’re about to. Because it’s inevitable.

“The most important thing in life is not to capitalize on your gains. Any fool can do that. The really important thing is to profit from your losses. That requires intelligence; and it makes the difference between a man of sense and a fool.”

William Bolitho

Investing Beyond the Numbers: The Role of Emotions

Writing this material turned out to be a little more difficult than I imagined. It lacks the specifics, numbers, math formulas, and graphs that I’m used to presenting topics with, and which are usually logically easy to derive, follow, and describe. However, this is not the case with the invisible aspects of investing – the ones hidden in our heads. Namely, with the feelings, moods and attitudes, which, however, although operating below the surface, turn out to be fundamentally important. It is they who drive our actions and really influence the results we will achieve. As the author of one of the most interesting books I have ever read – The Psychology of Money ( Morgan Housel) , shares with his readers right from the first page that “The key to how we manage money is not how smart we are, but how we act”.

In order to fully understand how and why we act in certain ways, we must delve into non-mathematical sciences that are completely foreign to us investors, such as psychology and even philosophy. And although it is difficult, I will still promise you that after the introductory words, the text will take on a slightly more structured appearance and what I want to tell you will be as ordered and systematized as possible.

I would like to be able to brag that in my entire investment career I have always been able to profit from my actions and I am a genius in investing. But I can not. And I, like most people, make mistakes, and I, like them, am subject to processes greater than my ability to foresee. I also have gray hairs from the times I actually wished I had no hair at all so I wouldn’t have to pull it out.

Wise men have said that

“experience is what you get when you don’t get what you want”

so I hope the pain of not always getting what I wanted has allowed me to gain a secondary benefit from my involvement in investing. Otherwise it would be of no use and all would be in vain. And if I don’t specifically sit down and think and organize the lessons learned along with the resounding slaps of investment failures, and let them randomly float in my head, then I commit myself to repeating them forever over and over again.

The Harsh Realities of Investment Losses

2022 was a disastrous year for me and the first such year in my long career of investing in the stock markets. Within the last year my investments have declined by just over 50% and while this only set me back 2 years, the feelings it created were strong and very painful. Only now, towards the middle of 2023, after a relatively stronger period since the beginning of the year, I have the opportunity to finally catch my breath, reduce the pace and stress and reflect on the past period to take stock.

“I told you. It happened just as I warned you?” are some of the most unpleasant words anyone can say to you. Even when said with care and good intentions, I’ve always seen them as spoken by a coward sitting on the sidelines waiting for the right moment to stab you with them. And of course he always manages to say them when it hurts the most.

“I told you to invest conservatively!”

“I told you there was a recession coming!”

“I told you the market can’t be beat!”

It has always been easy for me to turn my back on the person telling me these things and cover my ears. But where do I turn when I begin to hear myself uttering them to myself? How do I cover my ears when this voice of the cowardly loser whispers in my head, dictating:

“Give it up, go for it.” Put up with some 8-10% income per year and don’t bother anymore. You’re not good at this . “

I admit that in the most difficult moments of last year, in my despair and with tears in my eyes from anger and helplessness, such a decision seemed acceptable. I was very close to giving up and accepting that I wouldn’t be able to “break even” and it would be years of conservative investing before I could get back to the pre-2022 levels. But now that the storm and the worst have passed (that never seems to be certain), the thinking is more orderly and calm.

It was crystal clear to me that many of the emotions I had to juggle during this critical and difficult period were leading me to make even worse choices and contributing significantly to increasing my losses. But while this period lasted, it was impossible for me to deal directly with them. Now my desire and ambition are fully focused on rethinking the period and optimizing the processes in order to shake off the unnecessary additional burden of self-sabotage.

I would like to share my thoughts with you because I believe firstly that they are universal for every investor, and secondly because I think that in this way I will be able to help you.

Learning from Loss: The Psychological Cost of Investing

I will divide this material into two parts:

1. Why do we have strong feelings when we invest? Why do we hurt so much?

2. How to deal with these feelings and what is the way forward?

Part 1. Why do we have strong feelings when we invest? Why do we hurt so much?

The reasons we have feelings are generally clear – because we are human, not robots. We are subject to our human nature and we react. It is true that different characters experience the feelings with different strengths, but the common denominator is that we all suffer and feel uncomfortable when we lose money. If we take the line uttered by an actor who once said “Life is joy and sadness ” and apply it to the subject we are talking about, we can say that investing is joy and sadness . And here we’re going to bring up a fundamental truth that some novice investors probably don’t know, and others do, but don’t fully comprehend.

Financial gain is ALWAYS haunted by the shadow of pain and suffering.

And although there is no great surprise in this statement and even at first glance it seems fair and just, it is so only at first glance. But it is indeed unfair for two reasons:

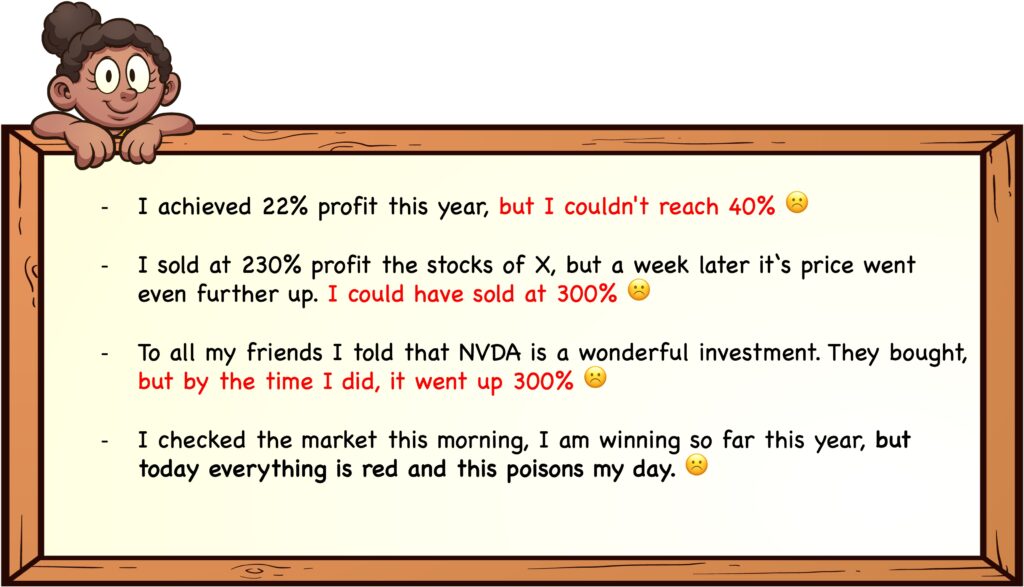

First – please don’t get confused that negative emotions only happen when you lose money. On the contrary. The tentacles of suffering in investing extend beyond losing money . This black octopus is often allied with ambition (our ego) and has the ability to reach at your mind even when you are making money. “But how so?” you ask. Some of you who are soccer fans may know what I’m talking about if you think of one player – Cristiano Ronaldo. On not just one occasion I have seen him leave the field feeling an inner anguish, easily recognizable on his face, that he had scored not three goals, but only two or none, even though his team had won. This is called sick ambition, and it is characteristic not only of soccer, but also of any other realms of life, including investments.

You would probably say that sick ambition and achieving great heights go hand in hand. If this soccer player didn’t have sick ambition, he wouldn’t be one of the best. We will not argue with this, but this fact must be clearly and precisely realized. There’s a price to be paid for everything, and it’s up to you to decide if you’re willing to pay it. But if you don’t have this sick ambition to be the most successful, the most famous or the richest, then we need to talk about building the mechanisms to prevent unnecessary suffering from seeping into many directions of your consciousness and poison you. Without controls and measures it has the potential to do just that. And when it does, you are provoked to take reckless and sudden actions to quell it and stop it from hurting. That is, you are prone to making mistakes.

The Battle Against Emotional Suffering in Investing

Here are some examples of how suffering bypasses its rightful authority to only be responsible for how we feel when we lose money, and instead intervenes in situations where we should be happy or at least indifferent (imagine a chessboard a board with more black fields than white or a yin-yang image but predominantly black as in the picture above).

how we suffer when we shouldn’t really

Many people in the know would recognize these feelings as various derivatives of the FOMO (fear of missing out) effect. Or in other words, the result of a constant restlessness and a feeling that no matter what you do, you are somehow missing out on good opportunities.

Now that we have seen that suffering is unfair in that it permeates everywhere, even where it should not be there at all, let me tell you the second reason why it does not seem quite fair to me. It has been scientifically proven that the feeling of suffering when losing is much stronger than the joy of winning . In English this is also called “loss aversion” .

This double injustice is simply terrible. And while our rebellion against such unfairness would initially be completely pointless and fruitless, the chance of overcoming it begins with realizing, that when you start investing, you start an unequal battle with your own character. Remember that the rules of the emotional game of investing are initially against you, and the marathon you’ve entered is both an uphill climb and a headwind.

Fighting an uneven battle against our own emotions

Conclusion

That’s the game, those are the rules, and you’re going to have to play by them. As clichéd as it sounds, it’s actually not external circumstances that cause us pain, but how we react to them. That is, we have a field of action. On the upside and with the headwind, we have the opportunity to strengthen our emotional body, change the status quo, and ultimately create more white spaces on the chessboard. Let’s talk more about how to achieve it in part 2.