SHARE

Many times, friends have come to me asking, “Nik, I have a certain amount of money. How should I invest it? You’ve been doing this for a long time.” I find myself giving a similar answer most of the time, so I decided it would be best to write it down. This way, I can direct people to the article as a kind of common recipe.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

Simple Investment Strategy

The short version of my advice is to choose a fund that follows a broad market index and invest in it, either in one go or regularly. Generally, this approach is sufficient. In fact, you’re likely to do better with your investments than people who are constantly adjusting their portfolios. If you’re not interested in reading further, here’s what you do: find a fund that tracks the US economy, like the S&P500 index, pick a stockbroker like Fidelity or Robinhood, and just go with it. Then, you can focus on other areas of your life, knowing this issue is taken care of.

But since you’ve chosen to keep reading, I’ll go into more detail. I believe this will be useful to you. However, before we continue, it’s important to set some expectations—without dampening your enthusiasm, but in the interest of fairness.

Understanding Risk

Firstly, when you decide to invest, you must understand that you’re taking on some risk. I’ll explain more about the level of risk shortly, but it’s crucial to know that risk works two ways. The first is the risk of losing money on your investments instead of gaining. The second, which is often not talked about, is the risk of losing sleep—both literally and figuratively. Depending on how and what you invest in, you might start worrying so much that it negates any financial gains you achieve. I’ll also explain that in a bit.

Personalizing Your Investment Strategy

Secondly, while my aim in writing this is to help as many people as possible with their investment decisions, it’s important to remember that everyone is different. We have different risk tolerances, energy levels, attitudes, and expectations. We all share the goal of growing our money, but our approaches can vary widely. Some would never consider stepping into a casino, others might play it safe by betting on black or red, and some are willing to risk it all on a single number, hoping for a big win. So, how can I offer specific investment advice without sitting down with you, asking questions, and getting to know you better? To give you tailored advice, I need to understand your goals, desires, and even your dreams.

Still, it’s possible to offer general advice that won’t steer you wrong, even without knowing you personally. I’ve given this advice many times and have never regretted it, whether to friends or strangers. I recommend this as a starting point for getting into investing. How far you’ll go and whether you’ll pursue investing further will depend on you. And it’s possible that as you learn more, this universal advice might not fit your needs perfectly, and you’ll seek out other options.

Let’s frame our discussion around a scenario I frequently encounter. We’ll use this situation to craft a typical investment profile for someone who is just beginning to consider their investment options.

“Nik, I have some savings or an inheritance that’s just been sitting in the bank. With inflation so high recently, it seems unwise to simply watch my money devalue. I think I should invest in something. My salary is sufficient for my needs and even allows for some savings. What should I do with this extra money? Until now, I’ve only used a savings account for it. Do you think I should invest? I haven’t looked into this much before, nor have I been very involved, and I don’t have much time or interest in delving deep into investment details.”

Here is your profile:

- Experience: None.

- Knowledge: Limited.

- Education: Not in finance.

- How much are you willing to lose: None.

- Duration of the investment: Unsure.

- State of mind: Cautious, but interested.

- Motivation: High. Main reasons being:

- “My money is losing value.”

- “Everyone is investing. I want too.”

- Time you can spare: Not much.

- Willingness to learn: Somewhat interested, but not deeply.

- Books read on the subject: None or maybe one.

With such a profile, finding a job might be tough because it doesn’t stand out in any specific area. They might not consider you seriously. But investing is different. This profile is enough to begin investing. In fact, with the strategy I’m going to share, you might not need to change much about your approach and can still do well.

Practical Investment Steps

Here’s my advice broken down into simple steps:

1. Put Your Money to Work: Don’t just leave it in the bank where it’ll lose value due to inflation.

2. Emergency Fund: Always have some money set aside for unexpected expenses.

3. Spread Your Investments: Don’t put all your money into one thing. This is known as diversification.

4. Invest in the Whole Economy: This means investing in a broad index that represents the economy.

5. Invest Consistently and With Discipline: Keep investing a regular amount. Also, put any dividends you get back into your investments.

6. Set It and Forget It: Once you’ve invested, don’t obsess over it daily. Think long-term.

7. Get Started: I’ll give you practical steps on where to start.

Now, let’s dive into these points in detail.

1. Invest your money, don’t keep it in the bank.

Money has three main functions:

– Money can buy things that make you happy and achieve your dreams.

– It gives you a sense of security.

– Money can help you make even more money to support the first two functions.

You’re likely familiar with the first two roles of money since they are quite intuitive and understood from an early age. The third role, making more money, is something that might sound like advice from Robert Kiyosaki, the author of “Rich Dad Poor Dad.” He might say something like, “Rich dads teach their kids how to make money work for them. Poor dads don’t.”

When your money is just sitting in a bank, it’s mainly there for safety, ready to help in difficult times. This is your emergency fund, and it’s crucial to have because life is full of surprises. But what about using money to improve your life now or to make more money? In a bank, your money doesn’t do much. Due to inflation, which is the gradual decrease in money’s buying power, your savings might buy you less and less over time. Even though banks pay interest, it’s often too little to offset inflation’s effects.

Ever wonder why banks pay interest? They want to motivate you to leave your money with them so they can use it to make more money for themselves. In reality, when your money is in the bank, it does work—it makes more money, but for the bank, not for you. Banks use your deposits to invest in things that earn them profit. They don’t just keep it in a vault.

2. Emergency fund.

As I mentioned earlier, having money in the bank does offer a benefit: it gives you security. If you suddenly lose your job, if your car needs repairs, or if something else unexpected happens, you’ll have quick access to cash to handle these situations. It’s wise to have enough saved to cover your living expenses for about six months. You probably know or can easily figure out your average monthly expenses. Just multiply that by six, and that’s the amount you should keep in a bank as your safety net. This isn’t about being scared of the future; it’s about smart planning and protecting yourself against life’s uncertainties.

3. Don’t invest in just one thing, in a single asset. This is called diversification.

You’re ready to invest, motivated, and now wondering what, where, and how. Let’s tackle the “what” first.

The crucial concept here is diversification. Though the term might sound complex, it is simple: don’t put all your money into one type of investment, like just one stock, one cryptocurrency, one type of precious metal, or one currency. The reason is the risk of picking something that might not perform as expected, leading to a loss instead of a gain. The saying “don’t put all your eggs in one basket” encapsulates this advice well.

If you’ve saved your money over time or earned it through hard work, you wouldn’t bet it all on a single number at a casino. Similarly, you shouldn’t do that with your investments, no matter how confident someone might be in their recommendation. It’s important to remember that advice often comes from personal viewpoints, which might not match your situation. This includes the guidance in this article, where I suggest looking both ways and using the crosswalk, rather than darting between cars.

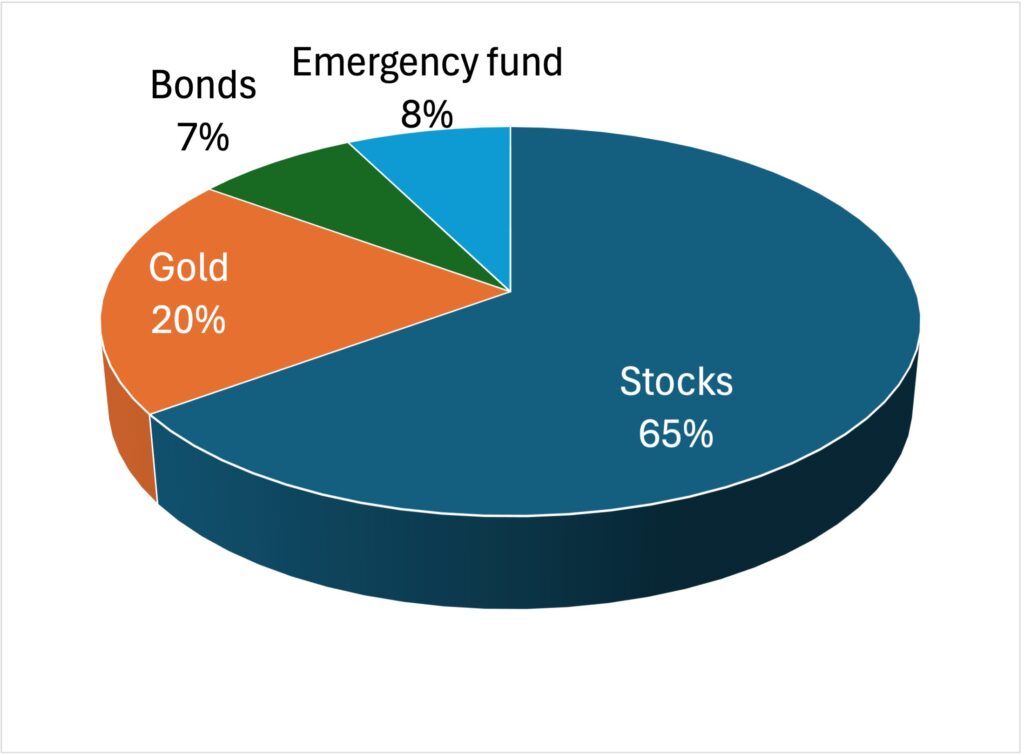

Investing involves two main types of risk: the risk of losing money and the risk of losing sleep. These risks are always present, and anyone claiming otherwise is not being truthful. However, you can minimize these risks, and diversification is a key strategy for doing so. By spreading your investments across various low-risk assets, you create a portfolio that’s less likely to keep you up at night. Remember, there’s always a trade-off; a conservative, low-risk portfolio won’t yield huge returns, but it’s a suitable choice given your profile. Here’s a conservative portfolio example:

– 10% in an emergency fund in a bank (or six months of expenses)

– 10% in physical gold or a gold fund

– 20% in bonds

– 60% in an equity fund tracking a broad index of the US economy

example portfolio

The emergency fund, gold, and bonds are low-risk, while the equity fund is relatively moderate. This portfolio is designed to protect against major downturns in the global economy, ensuring your investments don’t plummet. The percentages are just a guide; you might prefer a different distribution. A common piece of advice is to align your risk level with your age: younger investors can afford more risk since they have time to recover from any losses. Conversely, if you’re nearing retirement, it’s wise to be more conservative. This advice is straightforward and requires no further explanation.