SHARE

Introduction to Advanced Concepts

Hello with the second part of this material. I consider this part to be more advanced, so I hope you’ve already gone through the previous one. My purpose here is to introduce you to some additional things, as well as throw in two ideas to arouse your interest and curiosity. But let’s ride one at a time. I will begin with things for you to pay attention to.

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

Strategic Considerations for Choosing Strike Prices

Consideration 1. Choose an appropriate strike price based on your goals and risk comfort

The two examples in the previous part were at the two extremes – the price doubling in a month. Or rising by only 10%. But you can place a bet at any strike price. What’s more, you can look at the different premiums that are offered for different bets and assess your odds. If you are more conservative, you may prefer a higher strike price that is unlikely to be hit but will be paid at a smaller premium. In this way, you are expressing a preference to keep your shares. However, if you are an aggressive investor willing to risk your shares being sold, you can choose a lower strike price closer to the current value. This choice will naturally result in a higher premium. For example:

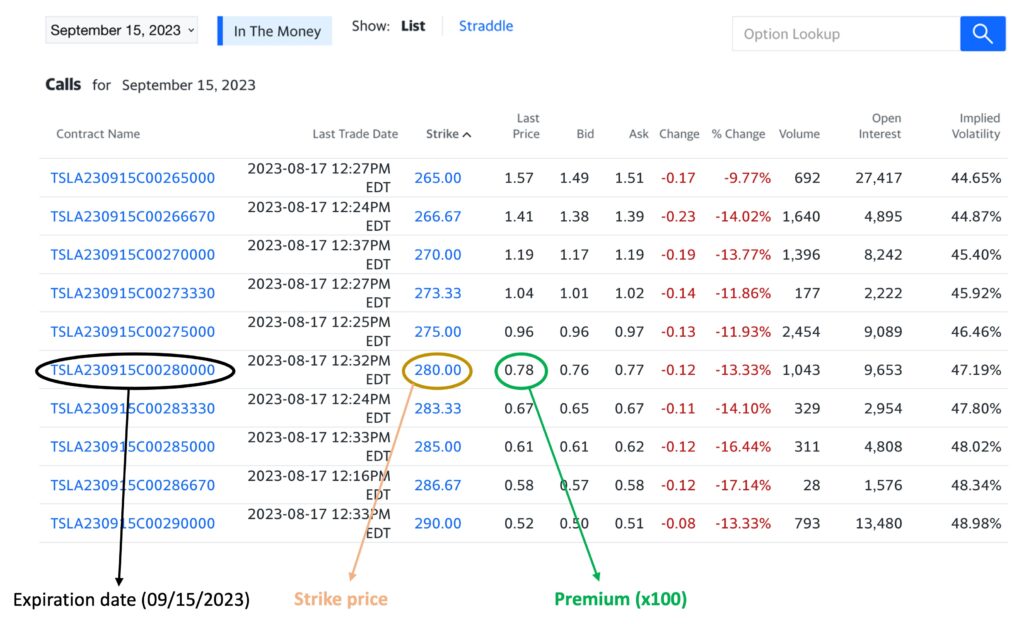

Example of Covered Call Options for Tesla

If we look at today’s date, August 16, 2023 ( premiums are dynamic and change daily and hourly, in a similar way to the price of the stock itself ), what premiums are being offered for Tesla with an expiration date of September 15, we see the following:

- Strike price $270 (+20% of current price), premium $119

- Strike price $275, premium $96

- Strike price $280, (+25% of current price), premium $78

- Strike price $290, premium $52

A $280 strike price would represent about 25% price increase within a month. According to some, this is conservative and safe enough to keep the stock from being sold. And the premium is $78. $78 may not seem like much to you, but if you do this 12 times a year, $78 turns into $936. If we do a simple math, with $22,300 worth of shares (100 times $223) you could generate over $900 per year. That’s about 4% and is equivalent to a rare high dividend paid out only by some of the big companies.

Example of a table for covered call options for Tesla with expiration date September 15, 2023

Consideration 2. Importance of Historical Stock Analysis

Before placing the bet, look at the historical movement of the stock for which you plan to sell a covered call option. Prepare well. The chart can provide information on whether the price has risen sharply in the past, by what maximum percentage and for what period of time. A little advance research can give you some certainty, although the past is not necessarily a guarantee of what may happen in the future. I have personally found such research to be of great benefit.

Consideration 3. Timing Your Options Around Market Events

Beware of selling a covered call options around times when you expect the release of public information that could affect the share price. Such moments can be for example, the date of the company’s quarterly financial report. Usually, the stock jumps up or down after the report, depending on whether it meets analysts’ expectations. Other significant times include economic reports, such as unemployment or inflation updates. Particularly in the last year, Federal Reserve meetings and interest rate decisions have greatly influenced the markets.

On the other hand, around such dates, the premiums paid out are higher due to the uncertainty these events bring. That is, these can also be moments to take advantage of.

Managing Your Investments During the Option Period

One of the disadvantages for you, if you exercise such a bet, is that for the period until the expiration date, you have your shares on hold, so to speak, and cannot operate with them. If you decide to suddenly sell them, you cannot do so until the period expires, even though you own them. But if your shares bear a dividend, you will continue to receive that dividend .

You can “cancel” the bet and “release” your shares at any time if you choose. To do this, you must pay a premium similar to the one you initially received. Depending on the share price’s performance since you sold the option, this premium could be larger (resulting in a loss) or smaller (allowing you to still profit). The price you pay increases as the share price approaches the strike price, indicating a higher probability that someone will exercise the option.

The two ideas

So, as I promised, before I end this text, I will share with you two scenario ideas for trading covered call options that you may find interesting.

Idea One: Enhancing Stock Sales with Options

Let’s say you own 300 shares of Microsoft stock that you’ve held for several years. You want to sell them, maybe because you want to buy a car or a make a down payment for vacation home. Or you may have decided that you have fulfilled your plan for this investment and prefer to switch to another one. Up until now, when you needed to sell stocks, you simply went to your stockbroker and sold them at their current market price. Let’s see what other sales opportunity there is.

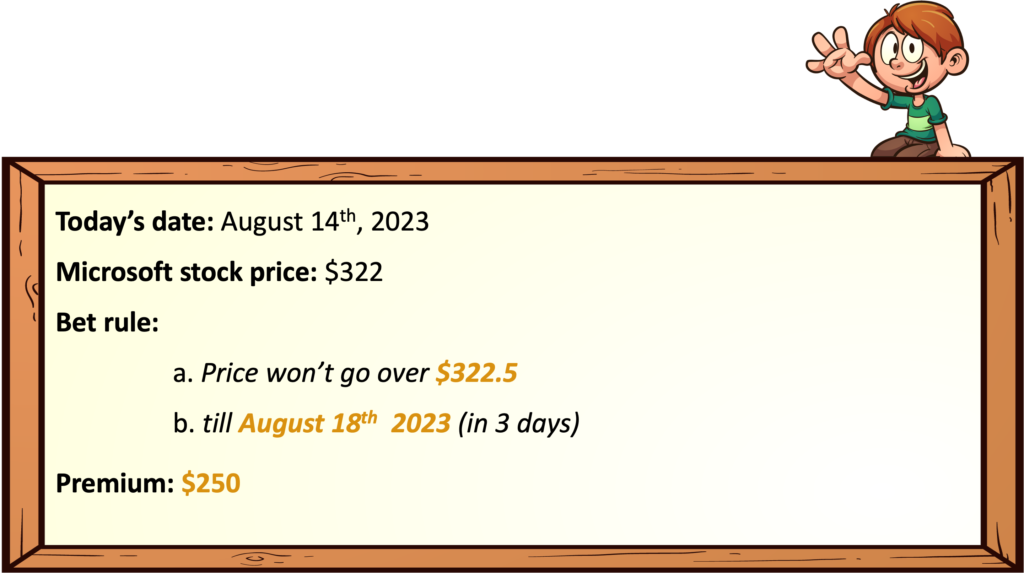

in 3 days

As of today, Microsoft’s price is $322, 300 times $322 = $96,600. That’s how much you would get if you sold them today, the way you are used to. But knowing what we’ve talked about so far, you can take extra money by making the following bet:

Idea 1

If the price goes past $322.5 (under a half % rise), your shares will sell at that price and you will take an additional premium of $750 (3 bets of 250 because you have 300 not just a hundred shares).

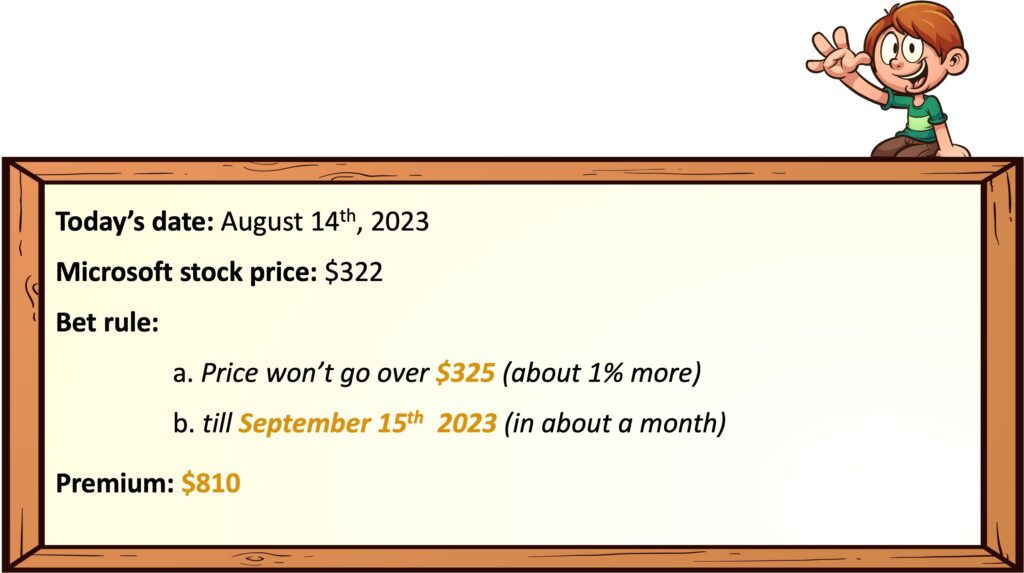

in a month

Or, if you’re not in a hurry, you can set a more distant expiration date – for example, September 15th. The more distant the maturity date you choose, the larger the premiums will be because it is harder to predict. It is generally expected to be more likely to reach higher levels by the more distant date. Then the offer will be as follows:

In this case, you will get 3 times $810 extra, or $2,430.

There are two catches here. The first catch is as we know – during the period until the maturity date you cannot suddenly sell your shares because they are so to speak locked in the deal. The second catch is that if the price does not pass the strike price, the shares are still yours and you have not sold them, as was your original intention. But you collect your premium anyway. And then you might make another similar bet. The risk is that during the bet, the share price can drop so much that even the premium you received won’t cover that downward difference.

Idea Two: Maximizing Returns with Long-Term Bets

You know we’ve talked about what kind of return you can expect on your investments. There are people who invest in funds tracking broad indexes like the S&P500, which on average historically can deliver between 8-10% returns per year. These people achieve the mentioned returns without much effort, and we generally view this kind of investing as conservative. Let’s see if we have any way to achieve similar or even higher returns with what we learned today.

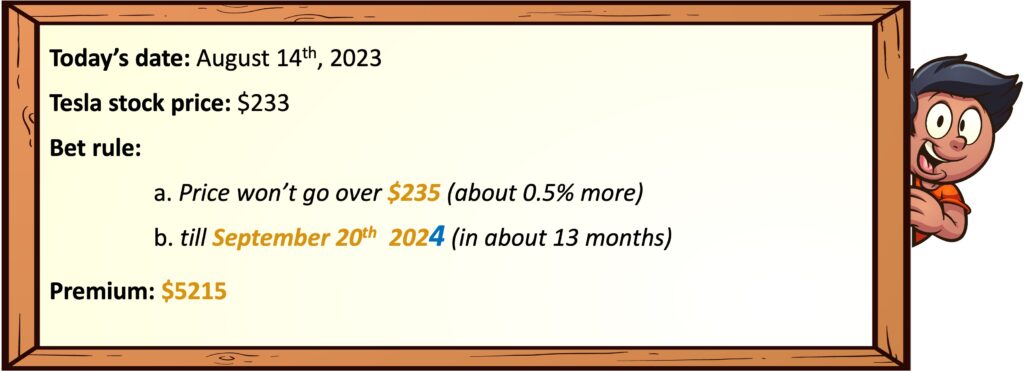

Let’s take the Tesla company again. It often pays higher premiums than other companies. The reason is the great interest in it, as well as the fact that the volatility of its share price makes it more difficult to predict. We look at what offer there is if we choose an expiration date far into the future – a year from now. We find the following:

Let’s do a simple calculation:

100 shares of Tesla at $233 (as of August 14, 2023, when I did this check) is $23,300. If we bet them in the above scheme, we would instantly get $5,215 , which is 22% of $23,300 or a 22% yield. Let’s do the usual breakdown and see the pros and cons of this bet.

Advantages

- You achieve returns at least twice that of investing conservatively in a broad index.

- The moment you place the bet you receive the money. You don’t have to wait a year to achieve this yield. You get it instantly and the money can immediately be reinvested or used in another way.

- If you need cash urgently and have nowhere to get it, and you don’t want to sell your investments, this is a way to generate some cash.

- If the price does not go above the strike price, after the end of the term you can bet them again in the same way.

- If the price goes above the strike price and the person who bet against you buys your shares at some point during this period, then you will achieve this return in a period of less than 1 year.

Disadvantages

- As we’ve said before, we can’t trade the stock while it’s staked unless we buy the option back. A year is a long time and it can strain you in some ways.

- It is possible that the price will exceed the maturity price by a lot and you will be unhappy that you missed out on theoretical further profits. But here I would counter with two things.

- One is that the benefit is really only in theory, because even if the price has passed, there’s no real telling of how it will play out in the future and at what point exactly you would sell them anyway. This is both an emotional issue and a difficult one to theorize.

- My second argument is that if you think about what your original plan was to achieve 20+% returns, you do it instantly – something that is not that easy to achieve. You are satisfied with having achieved your goal and look forward to repeating the same goal.

- One is that the benefit is really only in theory, because even if the price has passed, there’s no real telling of how it will play out in the future and at what point exactly you would sell them anyway. This is both an emotional issue and a difficult one to theorize.

- And finally – perhaps the most vulnerable point of this idea. What would happen if at the end of the period the share price is significantly lower than the strike price? Yes, you will have collected the premium, but if you decide to sell those 100 shares the moment they are released, the premium may not be able to cover the difference and you may end up at a loss. Of course, no one is forcing you to sell those 100 shares. On the contrary, you can bet them again immediately and get a new premium, but this time either the premium will be lower or the strike price. And if they sell at that lower strike price, you could again find yourself below the money you originally put down. But you may decide to wait until the share price recovers and place a new bet on better terms.

Closing Thoughts

That’s all I wanted to share with you about covered call options. You will have to continue on your own from here and do some more research yourself. Find out if and how your broker handles this.

In closing, I want to remind you that options, and in particular selling covered call options, are just another tool in your investor’s toolbox. There is no free lunch anywhere, there is always a trade-off and there is risk in every investment. Those taking the bets (buying your covered call option) are not falling from Mars and they also know exactly what they are getting into. Unlike stock trading, options involve direct competition and bidding between different parties. The “game” in options is a so-called “zero-sum game”, where for one to win, the other must necessarily lose. Often, the other side of your bets includes very experienced professionals who have been dealing with similar bets for years. To beat them, you will need knowledge, experience, and a willingness to experiment. I can only help with knowledge. The rest is all you. Good luck!