SHARE

Why are we trying to be ahead of the market?

Emotional Dynamics of Market Competition

The topic of getting ahead of the market is an emotional one. It is so because the very desire to earn more than we deserve is an emotional and quite natural human feeling that most of us are subject to. It may be caused by our ego, by our desire to prove ourselves, to succeed, to let others see that we are intelligent and superior to the average investor. So that we are not the boring driver who knows by heart the license plate number of the car in front of him. Because we are smart, competitive and probably high on self-esteem. And last but not least, of course, because we believe we can do it. Especially looking back at the historical price movements of individual companies

Watch my TEDx talk here

AI and the Hidden Price of Comfort | Nik Popgeorgiev | TEDxFolsom

What if technology gave us everything we wanted—yet left us with nothing to live for? This talk explores the hidden cost of AI-driven automation: the quiet erosion of purpose, meaning, and struggle.

“If only I had invested in this or that company and I would have been ahead”

But because the whole idea of getting ahead of the market is about feelings and emotions, by going down this path we lay a shaky foundation on which we will have to build. Because if success brings satisfaction, joy, pride and if you want a feeling of being better than others, then loss or even the apprehension of it will bring fear, dissatisfaction, self-blame, and low self-esteem. Emotions and investments are like water and oil.

That’s why for those on this path, building strong discipline, a plan, and a strategy are extremely important to minimize emotions and increase the chance of consistent success in the task at hand. And this is true in any area of life that you want to climb to the top. Beating the market is reserved for an elite group of investors and represents a pinnacle of sorts. By elite group, I don’t just mean geniuses, but rather a disciplined, knowledgeable, and experienced group. Failure to cultivate these qualities is one of the frequent reasons why the mass of investors fail in this endeavor.

The Allure of Winning

There is a lot of scientific research on why even though they know they are taking a lot of risk, investors do it. In her TED Talk – Why We Take Financial Risks , Elise Payzan presents an interesting study that claims that we are internally programmed to take risks and very often give in to the urge to settle with the safe just because we think we will manage to get more. Whether we want to admit it or not, we are greedy. It’s as if we suddenly get blind and we forget about the risk, we reject the possibility of losing, we drastically overestimate our skills and rely on previous successes, as if they necessarily guarantee future ones. Research shows that taking risks releases dopamine, even when the risk does not bring a reward. That’s simply how the human brain functions.

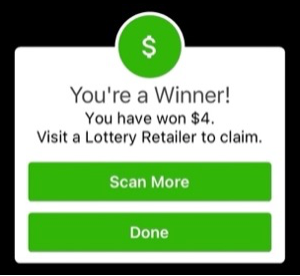

Scientists consider this issue as a phenomenon. Despite knowing that casinos generally win while gamblers lose, why do we still venture into them? What drives us to purchase lottery tickets with astronomically low odds of hitting the jackpot? Reflecting on last week’s improbable win, where my ticket doubled in value, I find myself contemplating reinvesting the winnings into two new tickets, fully aware of the likely outcome of both being losses. Am I expecting a miracle? And in fact, isn’t the real trade-off that life wants us to choose from. To be disciplined and a bit boring versus to believe in miracles.

I won!

Why is it difficult?

The Challenge of Market Efficiency

It’s time to talk about the most interesting part of this text, namely why it is difficult to beat the market and what is known about this topic. Let’s start by talking about a theory – The efficient-market hypothesis. (Effective in the sense of optimal, correct, accurate) This hypothesis asserts that markets very accurately reflect the real value of companies at a given time based on all the information known about them and the state of the economy as a whole. This means that the price already includes all available knowledge, and we should expect no big surprises. It appears the market has already predicted the future and valued the stock appropriately.

Imagine you want to sell your old car. If you don’t disclose all information about this car, such as a high-speed crash a year ago that damaged its structure (though not visibly), you could likely sell it for a higher price. This price would be more than what the market would offer for its actual condition, allowing you to make a greater profit than you really deserve.

However, if you provide this information and the entire history of the car since you’ve owned it, you can sell it at a much more accurate and fair price. Alternatively, if we consider you a middle-man, similar to trading stocks for profit, you could exploit the fact that you are fully aware of the damages. By purchasing the car cheaply and selling it for more, you take advantage of the buyer’s lack of information.

In stocks, to beat the economy-averaged returns of passively investing in a broad fund, you have to take advantage of either a lack of information about a particular company, or a common misconception among other investors. Let me give examples to make it clearer.

Examples of Market Opportunities and Misconceptions

First example

Imagine that you currently own shares of company X. If you were the first to know that its CEO, a well-known charismatic personality, had an accident and was in a life-threatening condition in hospital (perhaps you knew first because he crashed into your car…), you can sell the shares of this company before the other participants hear the news and therefore be able to realize a much more successful deal by getting rid of these shares. This happens before the word spreads and the share price drops sharply because shareholders will expect future problems in running the company without the strong personality of its CEO.

Second example

Imagine that in 2014 you decide to buy shares of a now famous electric car company. By 2014, you had the same knowledge that the market has about this stock, nothing more, but you invested in it at a very low price because the market did not see it as promising at that time. One day you wake up after 7 years and find that the value of those stocks has gone up a lot and if you sell them you will make a lot of money. In this example, you have taken advantage of the market fallacy or the common misconception as of 2014 that electric cars will not be as popular in just 7 years, or that this particular company will not achieve the success it has achieved.

Third example

Even more difficult to accomplish, uses two delusions within a year. You invested in the company Zoom (ZM) in 2020 during the Covid pandemic, taking advantage of the fallacy that telecommuting companies like Zoom would not be as critically needed during this period. Then you sold the shares after their price had jumped several times but just before they fell to low levels again. Capitalizing on the mistaken belief that this company would remain highly leveraged and unique among its competitors post-pandemic.

You probably already notice that I use the word “delusion” as a synonym for “underestimating information”, “not seeing ” or the opposite – “visionary seeing into the future”. All three describe a situation where there is a serious misconception of views about a company. For example – a financial report comes out, everyone reads the same information, but interprets it differently and predicts its future differently. Some say:

“Yes, the company has contracted with so many new customers, but they are small customers. This is not good. Why are there no big customers?”,

and at the same time others say to themselves:

“Yes, the company has contracted with so many new customers and they are small customers, which is good because the company is entering the small customer market. “

Depending on whether investors interpret the information as negative or positive for the company, they will react accordingly. Sometimes I have even seen investors debate the tone the CEO or CFO uses to present the report. Those who interpret the tone as pessimistic and see the financial statement as negative will sell their shares , anticipating a negative future. Those who interpret the report as positive and hear encouraging notes in the presenter’s speech will want to buy more because they see a bright future. If there are more sellers than buyers, the price will fall, and vice versa. In the end, it is the future that will show which opinion was correct and, accordingly, will adequately reward investors for their decision.

The Efficient Market Hypothesis and Its Implications

The theory of the “Efficient Market Hypothesis” claims that such divergences are rare and mostly short-lived. According to it, the market quickly adapts to knowledge, whether it’s news about the company in question or the just-released financial report, which eliminates short-term delusions and, accordingly, the potential they bring to profit from the divergence in expectations. That is, we can say that YES, there are opportunities, there are people who succeed in doing this, but imagine their skill level, the degree of depth and focus, the ability to see beyond – where others clearly fail. Imagine the extensive training needed, the countless books you need to read, and the numerous failures you have to overcome to develop this almost supernatural ability to see into the future, defying popular opinion.

Also imagine the level of self-discipline and decision-making required to take advantage of what others see in reverse. It is very important to understand here that one of the strongest behavioral patterns, namely “following the herd“, is detrimental to ultimate success. Because if we do what the market does, then the price will already have all the information calculated and we would not be able to take advantage of any difference in expectations. That is, individuality in decision-making, as well as seeing niches before other investors and, accordingly, abandoning them in time, and discovering next opportunities, are important in the ability to stay ahead of the market.

Market Anomalies and Investor Success

A few years ago, a relatively small part of the investment community first discovered and utilized a niche. This niche involved companies whose business model centered on creating a software product and selling it repeatedly. They concluded contracts for using the product over several years. The so-called SaaS – software as a service companies operating with a large margin due to the absence of a physical product and the absence of high costs for its continuous production. Investors have found that the development of these companies can grow much faster and much more predictably than, say, a refrigerator company.

The concluded long-term contracts guarantee the income for the coming years, and finding new customers and upgrading the product guarantees the future growth at high rates. Investments in such companies outperformed the market many times over several years, but at some point the information and the market caught up and the rates of return from owning shares of such companies declined.

Sometimes the process of finding the fair price goes through extremes. When word spreads, euphoria builds and many people begin buying shares of these companies. They hope for good profits and to beat the market returns they have seen in previous periods. This leads to a further increase in the price of these shares. They become overrated and overvalued. And at some point the so-called market rotation happens. Simultaneously, as if coordinated, investors who had bought shares earlier decided that the price was already too high, did not correspond to the company’s potential, and sold their shares. They make good profits, usually at the expense of those who joined last. They move on to other sectors or opportunities to invest in. As a result, the price falls and gradually stabilizes after an adequate revaluation.

Opportunities arise from over-expectation and delusion, and usually, only the most prepared investors who first see the opportunity take advantage of them. But how many of them are able to adapt and continuously, I emphasize the word continuously, repeat their success? It is difficult to name a specific percentage of all investors, some of whom are professionals, who manage to beat the market, but I have heard something in the realm of 20% and less. And these numbers are subjective because, as we talked about earlier, they must always, but absolutely always, be accompanied by a period for which the measurement is made.

An example of this is the bet Warren Buffett made with portfolio managers in 2007. He bet $1 million that a passive fund tracking the S&P500 will achieve higher returns over the next 10 years than other attempts to beat the market. On one hand , Buffett is said to be a serious proponent of the Efficient Market Hypothesis theory, but on the other hand, he himself has repeatedly done the exact opposite, finding anomalies in it. He is popular for successfully discovering undervalued companies to become the most successful investor of all time. But going back to the bet, he ends up winning it. 10 years later, the fund he initially invested in and subsequently did not look at, monitor, manage or touch, has outperformed the professional portfolio managers trying to pick individual companies in an attempt to prove that the market can (easily) be beaten.

Emotional Intelligence and Investment Success

Another reason it can be so difficult to beat the market is rooted in emotion. Often emotions apply great damage and undermine the investor’s attempts, because they make him prone to mistakes from impulsive decisions. The traps are many and I have touched on the subject in the article Biases and traps. Imagine how the investor, having done the difficult, almost impossible task of finding discrepancies in expectations about a company, must, on top of everything, slalom between these pitfalls and resist the sabotage of his own brain, which is constantly trying to drove him off the road.

Will past success, whether based on skill or chance, deceive us and mislead us about our own ability to recognize opportunities in the future? Are we going to resist the pressure of the rest of the investing community that doesn’t see what we see and end up doing what everyone else is doing, giving up a winning position. Or we will be greedy when we should be patient, or fearful when we should be aggressive. And what about the pain and regret that engulfs us when our bets don’t pan out and our expectations of profit are slapped with the whims and vicissitudes of the market?

Building a balanced, patient character is an ongoing and long-term process, taking years of continuous self-cultivation. Many investors keep journals in which they record not only financial information about the companies they are interested in, but also the feelings they go through, the mistakes they make, and the goals they set for themselves to build a character resistant to market storms. In this sense, it is a good idea to read not only books related to investments, but also books on self-improvement and dealing with emotions. Even psychology books if you will.

I’m sure you’ve already drawn your own conclusions, but I’ll try to help by summarizing them. Getting ahead of the market is difficult, but not impossible. If you are a new investor, my advice is to take a moderate and careful approach in your first forays into finding companies and opportunities beyond your investments in a fund that tracks a broad economic index. Seasoned, professional investors fail at what you hope for, so tread lightly in this territory. And never give up. Trials themselves are a journey, an experience, and not always the end goal is the most important.

Dreams exist for us to follow them. Sometimes, I myself become irritated when someone takes an extreme position on this matter and speaks out against making such attempts. If you look at the statistics of successful businesses, you can see that the majority of newly hatched companies go bankrupt a few years after their founding. Does this mean that entrepreneurs should give up and development in the world should stop ? Of course not. Same here. I wish you good luck!